Investing in Cryptocurrency – Where digital forms of money were once the save of tech geeks, nowadays, they’ve become so standard that your folks may be thinking about contributing.

This news could strike fervor into the hearts of fanatic crypto fans, yet it likewise implies there’s an ascent in individuals who need to get in on the “publicity” and put resources into cryptographic money without really seeing how they work.

Ensure you’re not one of them. I’ll diagram “11 things that everybody should know before investing in Bitcoin” and other digital forms of money, all refreshed for this crypto scene.

1. They’re Based on Blockchain Technology

You don’t need to be an investor to have known about blockchain innovation. Yet, could you have the option to clarify how it functions? For the vast majority, the response to that question is no.

Blockchain is the framework that upholds digital currencies. It’s also decentralized, subsequently offering an option in contrast to the conventional, brought together monetary establishments.

Rather than brokers like banks guaranteeing our present and savings accounts remain secure, the blockchain structures an unknown but public computerized ledger of trades – comprised of squares in a chain.

Utilizing complex cryptographic conventions and impetus frameworks, the actual clients keep the foundation running without forfeiting security, secrecy, or proficiency. At any rate, that is the hypothesis.

Assuming you’re thinking this sounds to some degree unclear, that is because the blockchain turns out diversely for every digital money.

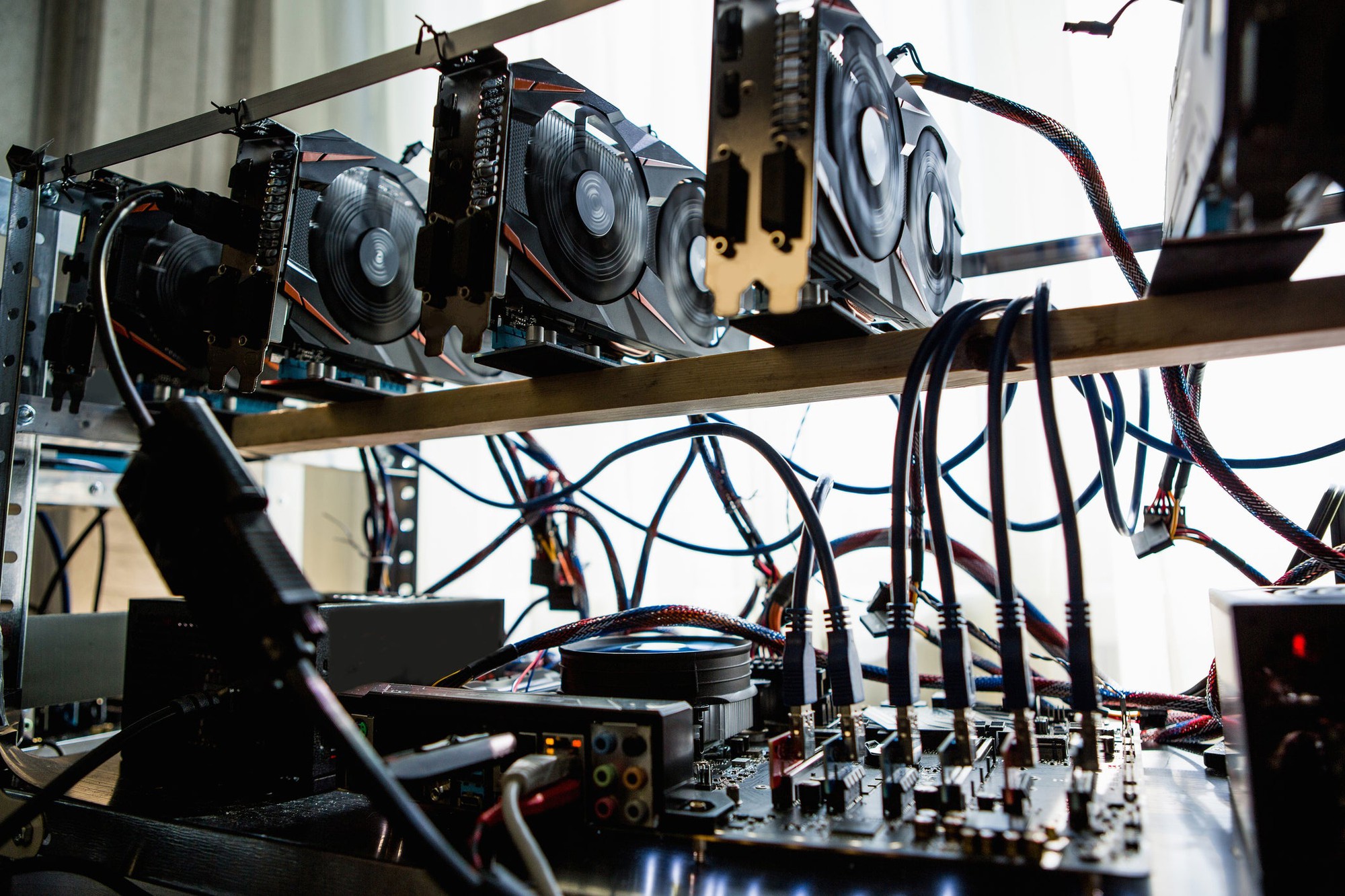

For example, on Bitcoin, users “mine” new squares: they look for the right cryptographic blend to confirm an exchange, which assists with framing the blockchain and brings about compensation of Bitcoin for the “excavators.”

Conversely, numerous other digital money systems use marking, which includes clients setting their resources down to confirm an exchange, with the chance of getting a part of exchange expenses.

2. You can Break Them up into Smaller Pieces

As you would have heard, in U.S dollar terms, numerous digital currencies are worth very much – in any event, when the worth of Bitcoin dropped fundamentally in 2019, it didn’t go underneath $3,000.

That is not extremely down-to-earth for purchasing an espresso or even another telephone. It’s additionally not helpful for financial backers who’d lean toward putting resources into digital money comparatively to a fragmentary stock rather than an entire Bitcoin.

Luckily, very much like U.S dollars can be parted into pennies and British pounds can be separated into pennies, Bitcoin separates into units.

The littlest of these is a Satoshi (named after Bitcoin’s organizer, Satoshi Nakamoto), worth 0.00000001 of one Bitcoin. A couple of different units, including the millibitcoins (0.001 of one Bitcoin) and microbitcoins (0.000001 of one Bitcoin).

Comparable frameworks exist for other digital money choices, as well. Along these lines, notwithstanding the recent cost gains in Bitcoin and others, normal people are not ‘locked out’ and can in any case put more modest sums in the crypto market.

3. There’s a Limited Supply

For a resource for being important, it should be scant – or if nothing else challenging to get. That is the reason oil is worth more than soil. It’s additionally (one reason) why the public authority can’t just print as much money as it needs and hand it out to residents.

Along these lines, the producers of cryptographic money needed to reproduce this element in the advanced world. Assuming that limitless measures of Bitcoin were accessible and prepared for the taking, it would be difficult to legitimize one single Bitcoin being worth a huge number of U.S dollars.

The stock of Bitcoin is 21 million, with the number still accessible to mine diminishing every day. Some see this as a significant flaw in how the framework functions, so there’s the theory that more coins might need to be delivered.

Normally, only one out of every odd digital money works very like Bitcoin. Notwithstanding, practically every one of them has some sort of monetary or innovative component to restrict the number of are accessible or make coins hard to acquire.

4. Use Them Anonymously

Whenever we store cash into a record with a monetary foundation, the bank knows precisely what our identity is. A similar isn’t accurate while you’re putting resources into cryptographic money.

Suppose you purchase some ether from a trade like Coinbase. You’ll then, at that point, need to move that advanced cash to a virtual wallet to store your ventures (more on your choices for this later).

The organization that has the wallet has no clue about what your identity is. All things being equal, you utilize two 16-digit passwords (a public key and a private key). The public key is for sending cash to the ideal individual, while the private key is for affirming the exchange.

As our information is turning out to be all the more promptly accessible to legislatures and few partnerships, this is turning into an increasingly important and well-known perk.

5. Mass Adoption is Still Far Off

With putting resources into Bitcoin and other digital currencies talked about so now and again, it can here and there feel like we’re on the cusp of mass reception, particularly as significant organizations like Tesla are now tolerating Bitcoin.

While interest is developing, as a general rule, we’re as yet quite far off. Mass reception implies many, a lot more individuals are purchasing digital money and involving it in their regular daily existence.

Whenever your grandparents give you your birthday present as Bitcoin, that is the point at which we’ve arrived at mass reception.

6. Digital Assets are Volatile

The volatility of the digital money market is a huge motivation behind for what reason we’re such a long way off mass reception.

By and large, the cost of Bitcoin varies by around 2.67% each day. For some private financial backers, this is way a lot of hazards. Envision eating at an eatery and discovering your feast’s cost had expanded when you were charged!

Simply take a gander at the diagram of Bitcoin’s cost throughout the most recent five years.

To try not to awaken in nervous perspiration around evening time stressing over the cost of your crypto venture, it’s judicious contributing just (a little level of) what you can bear to lose.

Many traders will accept stop-misfortune orders allowing financial backers to predefine the amount you’re willing to lose and permitting you to rest simply around evening time.

7. Portfolio Diversification is a Must

Since putting resources into digital currencies implies utilizing the Blockchain rather than fiat cash, it doesn’t imply that individual budget’s typical standards simply depart for good.

Similarly as with traditional contributing, to create future financial wellbeing, you need to differentiate.

That implies contributing just a little level of your absolute abundance into digital currency. Furthermore, it likewise implies spreading your speculation across various ventures. Why not put the rest in property or other innovations such as 5G through the financial exchange?

8. Costs Can be High

Since digital forms of money are considered options in contrast to conventional monetary foundations, you’d be pardoned for thinking costs are lower.

In any case, while this is the expectation for what’s to come, it’s most normal not the case at present.

At present, it’s more costly to buy and sell on a crypto exchange than to purchase a resource on, say, the New York stock trade. Why? Expenses are charged and dispersed to clients for assisting with keeping up with the trades.

9. They all Have Different Use Cases

Even though “cash” is the most famous term, “advanced resources” is more exact. Bitcoin rose to distinction as an option in contrast to actual cash. The picture of individuals attempting to utilize it to purchase pizza has stayed instilled in a large number of our psyches.

As a general rule, a large number of the “coins” aren’t essentially made to be money (or rather, a mechanism of trade). The crypto world is regarding tech too, not simply finance!

For example, Ethereum intends to lay out a stage for applications utilizing brilliant agreements. Its local coin ether (ETH) powers this. ETH can be exchanged, held in a wallet, and utilized for buys and deals, however, it wasn’t grown exclusively to be money and that’s it.

Likewise, EOS is a brilliant agreement stage attempting to help decentralized applications match non-blockchains applications.

Other digital currencies have use cases like betting and amusement.

Notwithstanding, since creating a trading strategy for digital forms of money has become. So well known, you could contend that their essential use case is as a theoretical resource.

10. There are Various Types

Albeit “advanced resources” is a more exact class for everything digital forms of money, we can be more exact than that. There are four fundamental kinds of cryptographic forms of money: digital currencies, altcoins, forks, and tokens.

At this point, you should know that cryptocurrencies are advanced monetary standards made utilizing cryptographic conventions (computerized codes).

Bitcoin is an undeniable model. Even though it wasn’t the absolute first digital money, it was quick to be decentralized.

Litecoin is another digital currency – it depends on the source code of Bitcoin and intends to make exchanges less expensive and more proficient.

In any case, shouldn’t something be said about the different kinds I’ve laid out?

Altcoins are digital forms of money planned as options in contrast to Bitcoin. Though Litecoin and ETH work with Bitcoin and don’t expect to supplant it completely, altcoins do.

Heavenly is an illustration of an altcoin, and it can empower an organization of monetary frameworks for sending and exchanging a wide range of monetary forms.

You can’t have altcoins without forks, which change a current crypto convention to account for an altcoin. For instance, Bitcoin Cash is a fork of Bitcoin because it empowers more exchanges per block. Accelerating the sluggish exchange paces of Bitcoin.

Then, at that point, there are tokens: a general term for resources made on crypto stages. Which fill a particular role that isn’t being cashed.

Numerous crypto stages have two monetary forms and tokens. For example, on Ethereum, there’s both the cash ETH (utilized for exchanges) and ERC-20 tokens (utilized for shrewd agreements).

11. There are Different Ways to Store Them

Hot wallets are situated on the web so you can get to them from any place. For example, the trade Coinbase has its cloud wallet.

Interestingly, cool wallets hold digital money disconnected in equipment like USB. Assuming you lose that USB, you have no chance of getting to your record or speculation.

There’s a tradeoff between security and comfort here.

Would it be a good idea for me to Invest in Cryptocurrency?

Indeed, it’s over to you now! These contemplations are only a beginning stage for your crypto interest in 2021.

Be that as it may, recollect that, I’ve just truly started to expose the contemplations behind crypto contributing here. Before you feel free to put resources into cryptographic money. I suggest doing your examination on the particular computerized asset(s) you’re keen on. Knowing the unpredictability and how much gamble you’re taking.