How To Trade In The Falling Wedge Pattern? – The falling wedge design or dropping example is one of the advantageous examples that cautions the financial backers concerning the future bullish second. This article is a specialized way to deal with exchanging this example and even features a few focuses that should be recollected before exchanging this example. Along these lines, jump profound into it to know more.

What Is A Falling Wedge Pattern?

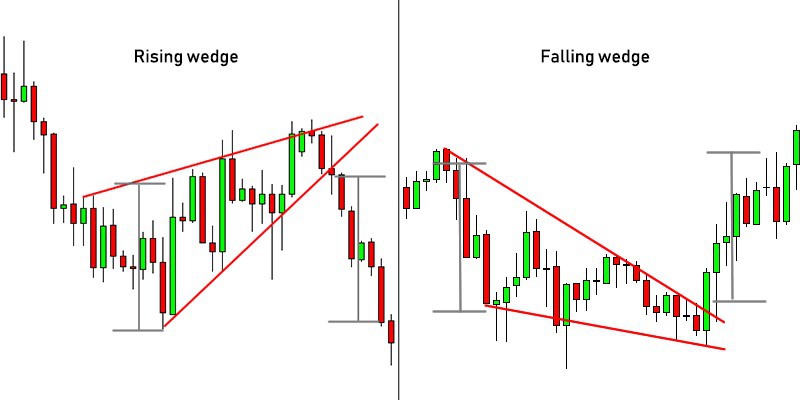

The falling wedge pattern is a continuation design. It is framed when the value skips between two descending inclining and meeting trendlines. Even though it is an arrangement of a bullish graph, it demonstrates both inversion and continuation designs. It relies upon where it shows up in the pattern.

How To Identify A Falling Wedge Pattern?

The falling wedge design is clarified both as a bullish and negative example. For that reason, individuals regularly become befuddled while distinguishing the example.

In any case, you can assess it with the assistance of the bearing of the pattern when this example shows up. Assuming that the model shows up in an upswing, it is the continuation design. However, a downtrend shows a downtrend.

How To Trade In The Falling Wedge Pattern?

You can exchange the falling wedge design utilizing the accompanying specialized examination:

Falling Wedge Continuation Pattern

As talked about over, the plummeting wedge design shows up inside an upswing during a combination in costs. Whenever you associate with the worse high points and worse low points, there is a slight descending inclination to the wedge design. It occurs before the costs rise at last. Subsequently, the breakout helps in continuing the bigger upswings.

Also, merchants look to the beginning stage of this example to gauge the upward distance between help and obstruction. Then, at that point, you want to cover a similar distance in front of the cash cost. Notwithstanding, you need to realize that the breakout will happen just a single time. Thus, keep the top stopping point in the objective.

Falling Wedge Reversal Pattern

You can involve a falling wedge specialized investigation to recognize the inversions on the lookout. You can likewise utilize trendline investigation to interface both worse high points and lows to make the example easy to recognize. Whenever there is a break and close over the obstruction, the trendline will flag the passage into the market.

For affirmation, dealers need to look to the volume marker to see higher volume in the move-up. Further, you could expect uniqueness when the market is making worse low points, yet the marker is showing more promising low points. It demonstrates a potential inversion.

Benefits and Disadvantages Of A Falling Wedge Pattern

This example enjoys various benefits:

- It happens habitually on the lookout.

- Permits dealers to get into the moving business sector after they have missed the underlying move.

- Presents straightforward stop, section, and cutoff levels.

- Gives unique open doors to a positive gamble reward proportion.

Despite these benefits, this design additionally has a few constraints that are as per the following:

- It very well may be somewhat uncertain to beginner brokers.

- Further confirmation utilizing other specialized markers and oscillators is required.

- It is for the most part mistakenly distinguished.

- It means both inversion and continuation design

Conclusion

Even though it is exhausting to observe the ideal example during fitting economic situations, financial backers never apply the previously mentioned rules and ideas to track down worthwhile exchanging of valuable open doors.

Most importantly, these examples are viewed as the most proficient approach to recognizing pattern inversions and in any event, securing productive methods to purchase before the development of a recent fad. Nonetheless, it is important to know about certain elements that can affirm the example. These focuses are as per the following:

- The falling wedge bullish example shows up in the swing low of a downtrend.

- The trendline levels ought to have somewhere around three contacts to affirm the example as a wedge.

- When the value breaks out, the example becomes tradable over the trendline opposition with a strong bullish light.

- In any case, now and again, you could observe a higher move in the costs without seeing any retracement.

- The best method for halting a misfortune is to decrease it in the present moment for certain vacillations in the cradle.

Thusly, this way you will want to exchange the falling wedge design easily.