The cryptocurrency market never stands still. Each cycle brings new narratives, fresh innovation, and unexpected leaders. As investors look ahead, Bitcoin Price Prediction 2026 has become one of the most searched topics across financial platforms. With Bitcoin historically leading every major bull run, the question is no longer whether crypto will rebound, but how high it could go and which altcoins might outperform the giants.

Bitcoin has repeatedly proven its resilience. From early volatility to institutional adoption, it remains the benchmark of the digital asset market. However, every bull cycle also introduces emerging projects that capture investor attention and deliver exponential returns. As we approach the next major expansion phase, many analysts believe that while Bitcoin could reach new highs, high-growth altcoins such as APEMARS may potentially generate even stronger percentage gains.

This in-depth Bitcoin Price Prediction 2026 explores market cycles, macroeconomic influences, institutional adoption, technological upgrades, and the rising interest in new-generation crypto tokens. By analyzing historical trends and current data, we aim to present a realistic yet forward-looking outlook for BTC, ETH, and emerging players.

Understanding Bitcoin’s Market Cycles

Bitcoin operates in distinct market cycles that typically follow a pattern tied to its halving events. Each halving reduces the block reward, limiting new supply and historically triggering long-term bullish momentum. When discussing Bitcoin Price Prediction 2026, it is essential to understand how these cycles shape price action.

Previous bull markets in 2013, 2017, and 2021 demonstrated exponential price growth following supply reductions. After each cycle peak, Bitcoin experienced sharp corrections before stabilizing and beginning accumulation phases. By 2026, Bitcoin could be in the latter stages of a post-halving expansion cycle, potentially pushing toward new all-time highs.

The combination of limited supply and rising global demand strengthens the long-term case. Bitcoin’s maximum supply of 21 million coins remains one of its most powerful value propositions. As adoption increases, scarcity becomes more pronounced, supporting higher valuations.

Macroeconomic Factors Influencing Bitcoin Price Prediction 2026

Macroeconomic trends play a crucial role in shaping any Bitcoin Price Prediction 2026. Inflation, interest rates, global liquidity, and monetary policy significantly impact investor appetite for risk assets.

During periods of economic uncertainty, Bitcoin is increasingly viewed as digital gold. Its decentralized nature and fixed supply appeal to investors seeking alternatives to traditional fiat currencies. If inflation concerns persist globally, Bitcoin could benefit from renewed demand as a hedge against currency devaluation.

On the other hand, rising interest rates can temporarily reduce risk appetite. However, as economic cycles shift and central banks eventually pivot toward easing policies, liquidity tends to flow back into high-growth assets, including cryptocurrencies.

By 2026, if global monetary conditions stabilize and risk appetite strengthens, Bitcoin may see strong institutional inflows, supporting bullish price projections.

Institutional Adoption and Long-Term Growth

Institutional involvement has transformed the crypto market. Hedge funds, asset managers, and even pension funds now allocate portions of their portfolios to digital assets. Any serious Bitcoin Price Prediction 2026 must consider this structural shift.

The rise of regulated crypto investment vehicles and improved custody solutions has lowered barriers for large investors. Bitcoin exchange-traded products and regulated derivatives markets enhance liquidity and price stability.

As institutional participation grows, volatility may gradually decline while overall market capitalization expands. Long-term capital inflows could drive Bitcoin toward higher valuation thresholds, potentially reaching levels once considered unrealistic.

This steady accumulation by large players often precedes sustained bull runs, creating strong support levels during market corrections.

Ethereum’s Role in the 2026 Crypto Landscape

While discussing Bitcoin Price Prediction 2026, it is impossible to ignore Ethereum. ETH remains the backbone of smart contracts, decentralized finance, and NFT ecosystems.

Ethereum’s transition to proof-of-stake improved energy efficiency and network scalability. Continued upgrades aim to enhance transaction throughput and reduce fees, making the network more competitive.

Although Bitcoin dominates as a store of value, Ethereum leads in utility. Many analysts predict that ETH will grow alongside Bitcoin, benefiting from expanding Web3 adoption.

However, percentage gains in major assets often lag behind smaller-cap altcoins during peak bull cycles. This dynamic opens the door for emerging tokens like APEMARS to potentially outperform in relative terms.

The Rise of Emerging Altcoins in 2026

Every bull market produces breakout projects. In 2017, it was ICO tokens. In 2021, it was DeFi and meme coins. Looking toward Bitcoin Price Prediction 2026, attention is already shifting toward innovative micro-cap tokens.

APEMARS is being discussed as one of these potential high-growth assets. Smaller market cap coins often carry higher risk but also offer exponential upside potential. If strong community support, tokenomics, and strategic development align, returns can significantly outpace large-cap coins.

It is important to remember that while Bitcoin may deliver stable long-term growth, emerging altcoins can generate rapid gains during peak speculative phases. Investors seeking higher risk-adjusted returns often allocate a portion of their portfolios to promising new projects.

Could APEMARS Outpace BTC and ETH Gains?

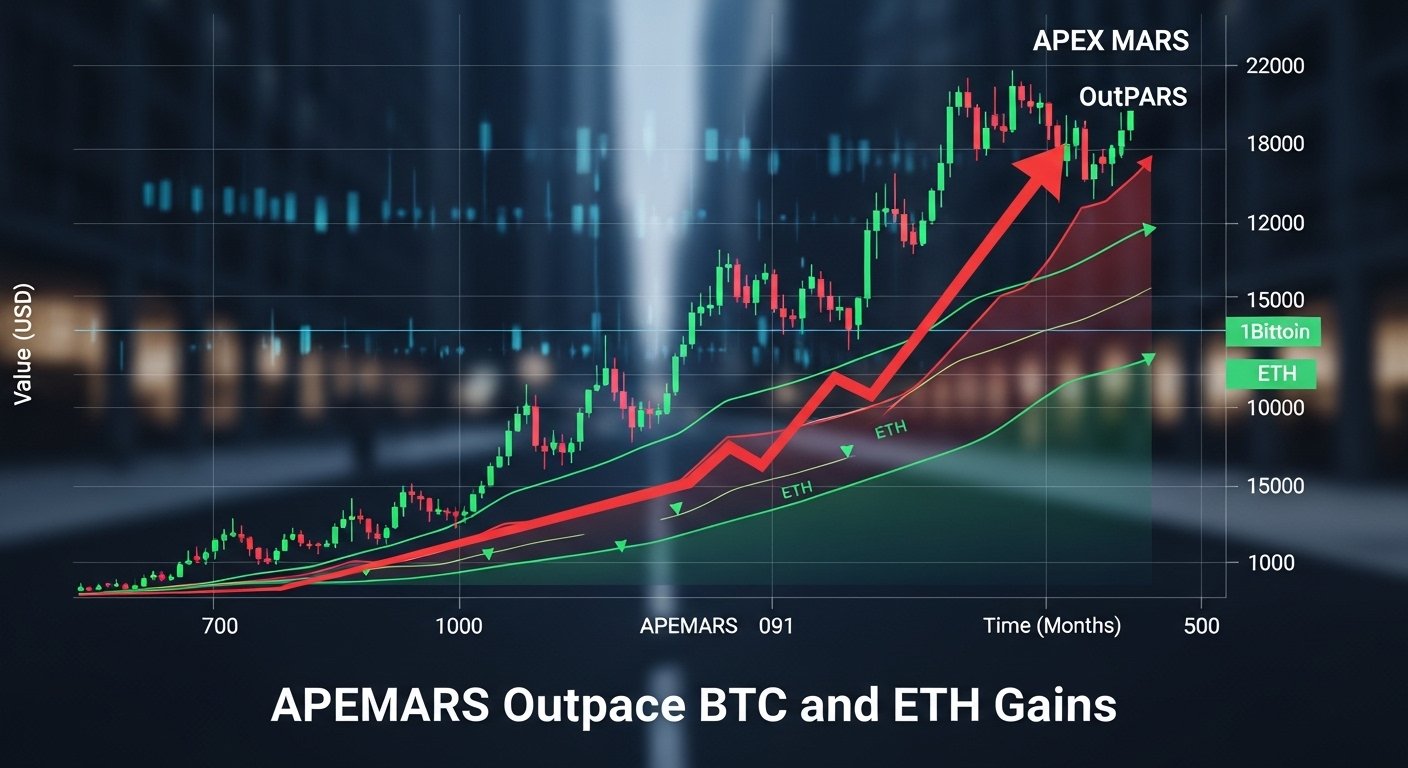

When analyzing Bitcoin Price Prediction 2026, comparisons between BTC, ETH, and rising tokens become inevitable. Bitcoin may double or triple in value under strong bullish conditions. Ethereum could also deliver impressive returns through ecosystem growth.

However, APEMARS, as a smaller-cap token, has greater room for percentage expansion. Early-stage tokens can experience rapid adoption cycles fueled by community engagement and social momentum.

That said, high growth potential also carries higher volatility. Investors must evaluate fundamentals, roadmap development, token distribution, and real-world utility before making decisions.

If APEMARS successfully builds strong use cases and gains exchange listings, it could indeed outperform larger assets in percentage terms. But sustainability depends on long-term ecosystem development rather than short-term hype.

Technical Analysis and Price Targets

Technical indicators provide additional insights into Bitcoin Price Prediction 2026. Long-term chart patterns show higher highs and higher lows across multi-year cycles. Moving averages, Fibonacci retracement levels, and historical resistance zones offer guidance on potential price targets.

If historical growth rates continue, some analysts project Bitcoin could reach six-figure valuations by 2026. Conservative projections suggest steady growth aligned with institutional adoption, while aggressive forecasts anticipate explosive gains driven by global liquidity expansion.

Ethereum could follow similar patterns, benefiting from increasing blockchain adoption and network improvements.

Meanwhile, emerging tokens like APEMARS may rely more heavily on narrative momentum and community-driven growth, making price predictions less precise but potentially more dramatic.

Risk Factors to Consider

No Bitcoin Price Prediction 2026 would be complete without acknowledging risks. Cryptocurrency markets remain volatile and sensitive to regulatory developments.

Government policies, taxation rules, and compliance frameworks could influence market dynamics. Additionally, technological competition among blockchain platforms may impact asset performance.

Market psychology also plays a critical role. Fear, greed, and speculative cycles can drive dramatic swings in valuation. Investors must practice risk management and diversification to navigate these fluctuations.

Despite these risks, the broader trajectory of blockchain innovation suggests continued expansion in digital asset adoption.

The Future of Crypto Beyond 2026

Looking beyond Bitcoin Price Prediction 2026, the crypto industry is evolving toward real-world integration. Tokenized assets, decentralized identity systems, and blockchain-based financial infrastructure may redefine traditional finance.

Bitcoin’s role as a reserve digital asset appears increasingly secure. Ethereum continues expanding its ecosystem. Emerging projects like APEMARS aim to capture niche communities and innovate within specific sectors.

As technology matures, regulatory clarity improves, and institutional confidence grows, the next wave of crypto adoption may surpass previous cycles in scale.

The market’s future likely belongs to a combination of established giants and agile newcomers capable of adapting to evolving demands.

Conclusion

Bitcoin Price Prediction 2026 presents a compelling outlook shaped by historical cycles, macroeconomic forces, institutional growth, and technological innovation. Bitcoin remains the foundation of the crypto market, with strong potential to reach new highs in the coming years.

Ethereum continues to strengthen its position through smart contract utility and network upgrades. Meanwhile, emerging tokens like APEMARS introduce high-risk, high-reward opportunities that could outperform in percentage terms during bullish expansions.

Ultimately, the next wave of crypto growth may not be limited to a single asset. Diversification, informed analysis, and disciplined strategy remain essential for navigating the evolving digital economy. As 2026 approaches, investors who understand both stability and innovation may be best positioned to capitalize on the opportunities ahead.

FAQs

Q: What is the realistic Bitcoin Price Prediction 2026 based on historical trends?

Historical trends suggest that Bitcoin often experiences strong price appreciation following halving cycles. If adoption continues and global liquidity improves, some projections estimate Bitcoin could potentially reach six-figure levels by 2026. However, actual outcomes will depend on macroeconomic conditions, institutional participation, and market sentiment.

Q: Can APEMARS realistically outperform Bitcoin and Ethereum?

Smaller-cap tokens like APEMARS have the potential to outperform BTC and ETH in percentage gains due to their lower market capitalization. However, this also involves significantly higher risk. Long-term performance depends on utility, development progress, community strength, and broader market conditions.

Q: How does Ethereum factor into Bitcoin Price Prediction 2026 discussions?

Ethereum plays a major role because of its smart contract capabilities and expanding ecosystem. While Bitcoin is viewed as a store of value, Ethereum supports decentralized applications and DeFi growth. Many investors consider both assets complementary within diversified portfolios.

Q: What risks could prevent Bitcoin from reaching projected 2026 targets?

Regulatory uncertainty, global economic downturns, technological competition, and shifts in investor sentiment could slow Bitcoin’s growth. Additionally, unexpected macroeconomic tightening or liquidity contraction may limit price expansion despite strong fundamentals.

Q: Should investors focus only on Bitcoin for 2026 gains?

While Bitcoin remains a cornerstone of the crypto market, diversification across established and emerging projects can balance stability with growth potential. A strategic mix of Bitcoin, Ethereum, and promising altcoins like APEMARS may provide broader exposure to the next wave of crypto innovation.