The Crypto Markets are on the Verge of Collapse as Jane Street and Jump Pull Out.The world of cryptocurrency has always been a rollercoaster ride, and the latest news is no exception. Jane Street and Jump Trading, two significant players in the crypto market, have recently announced their exit from the industry. This development has caused ripples throughout the cryptocurrency community, with many wondering about its implications for Bitcoin liquidity. This blog post will explore what this means for traders and investors and offer tips on navigating a bear market. So buckle up, and let’s dive into the fascinating world of Bitcoin liquidity!

Jane Street and Jump Trading are the latest to leave the crypto market

Jane Street and Jump Trading have been prominent players in the cryptocurrency market for some time now. So, Jane Street, a quantitative trading firm, has been involved in Bitcoin since 2017. Meanwhile, Jump Trading is a well-known electronic trading firm that has also made its mark in the crypto world.

However, recently both companies announced their exit from the cryptocurrency industry, citing various reasons, such as regulatory uncertainty and liquidity concerns. This news surprised many who thought these firms would stay put amidst growing excitement around cryptocurrencies.

The departure of these significant players raises questions about the future of Bitcoin liquidity. With fewer big names participating in this space, will there be enough buyers and sellers to keep up with demand? Will prices become more volatile due to decreased liquidity?

Despite this setback, it’s important to note that other firms continue to invest in cryptocurrencies. For example, Goldman Sachs recently launched a cryptocurrency trading desk while JPMorgan Chase is exploring blockchain technology.

While Jane Street and Jump Trading leaving the crypto market may cause temporary disruption, it’s not necessarily indicative of an impending collapse of the entire industry.

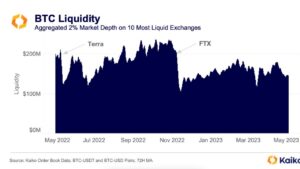

Bitcoin liquidity is drying up.

Bitcoin liquidity is drying up as more institutional investors leave the cryptocurrency market. The recent departures of Jane Street and Jump Trading have raised concerns about the future of Bitcoin. Liquidity refers to the ease with which Bitcoin can be bought or sold without significantly affecting its price.

The lack of liquidity in Bitcoin means that large sell orders could lead to significant price drops, making it difficult for investors to exit their positions quickly. This has led some experts to speculate that a further reduction in liquidity could cause a crash in the cryptocurrency market.

Related Article;

In April, Bitcoin spot trading volume dropped by 70%

However, others argue that this may be a good thing. Some believe reduced volatility resulting from lower trading volumes will make cryptocurrencies more attractive to mainstream investors looking for stable investments.

While short-term challenges may be associated with decreasing liquidity, it is still being determined what the long-term implications will be for Bitcoin and other cryptocurrencies.

The implications of this for the future of cryptocurrency

The recent departure of Jane Street and Jump Trading from the cryptocurrency market has raised questions about the future of digital currencies. While some experts are worried that this could further reduce Bitcoin liquidity, others believe it might ultimately benefit the industry.

One potential outcome is that smaller players in the market can fill the gap left by these larger firms. This could create more opportunities for innovation and competition within the cryptocurrency space. Additionally, it may help with decentralization efforts, as fewer big players dominate the market. The Crypto Markets are on the Verge of Collapse.

However, there are also concerns about how this will impact the institutional adoption of cryptocurrencies. If major financial institutions continue to drop out of crypto trading, it could discourage other large investors from getting involved. This could limit growth and development in the industry overall.

Another possible consequence is increased volatility in cryptocurrency prices due to lower liquidity. With fewer buyers and sellers on exchanges, price swings could become more extreme than they already are.

While there is no doubt that Jane Street and Jump Trading’s exit from crypto trading has implications for its future viability as an investment option, it remains to be seen precisely what those implications will be until we see how things play out over time.

How to trade in a bear market

Navigating a bear market can be challenging, but with the right strategy and mindset, traders can still find success. It’s essential to stay informed about the latest market developments and have a solid understanding of technical analysis.

One critical approach is to focus on short-term trading opportunities rather than long-term investments. By taking advantage of volatility and using stop-loss orders, traders can reduce their risk exposure while capitalizing on market movements.

Another vital aspect is diversification. Traders should consider investing in alternative cryptocurrencies or asset classes to spread risk and protect against losses.

Ultimately, it’s crucial not to let emotions drive decisions during a bear market. Fear and panic can lead to impulsive actions that result in significant losses. Instead, you can take a calculated approach based on sound analysis and stay disciplined with your trading plan. The Crypto Markets are on the Verge of Collapse.

Bitcoin liquidity may be on the brink as Jane Street and Jump Trading exit crypto markets, but this doesn’t mean it’s time for investors to abandon ship. With careful planning and strategic execution, profit opportunities exist, even in challenging times.

yasmin ocp

triamterene 37.5 mg hctz 25mg caps

toradol order