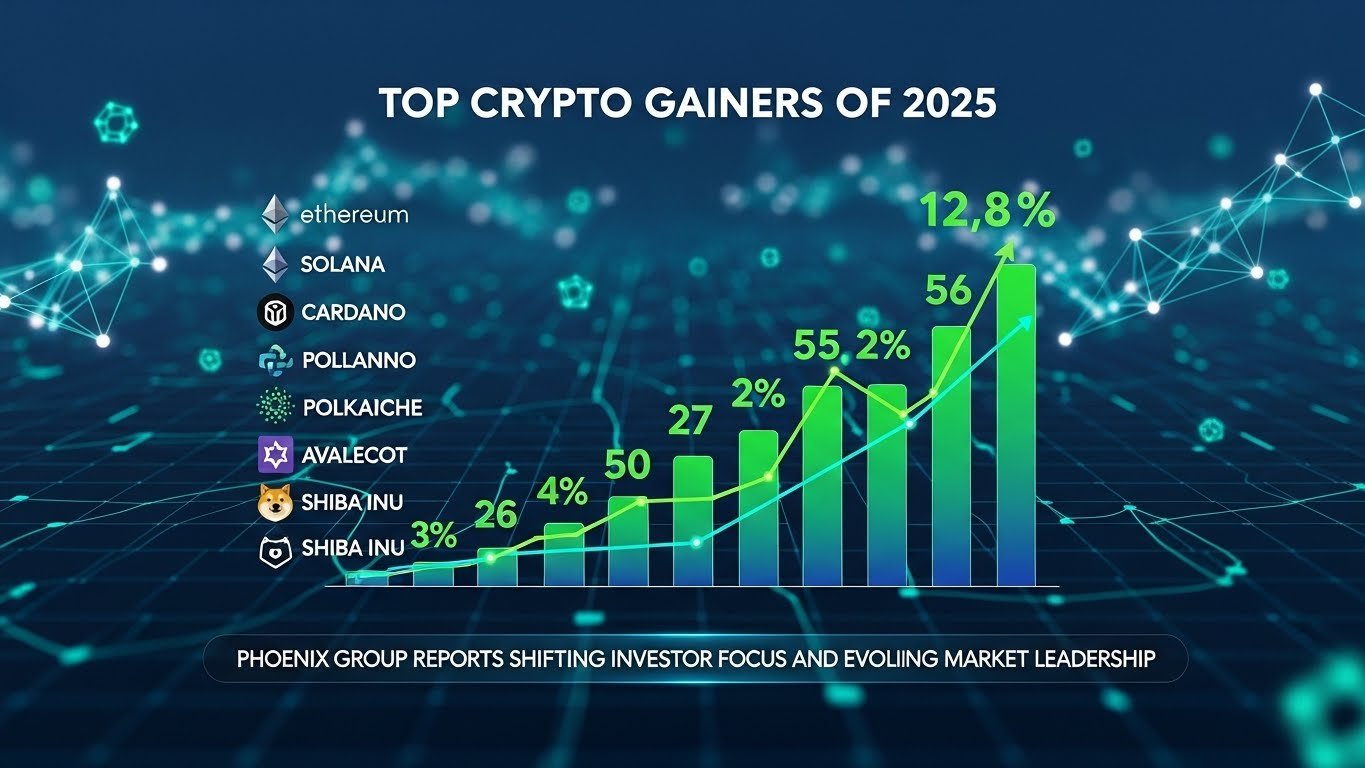

The cryptocurrency market in 2025 has delivered one of its most dynamic and transformative years to date, with altcoins stepping firmly into the spotlight. According to Phoenix Group reports, the top crypto gainers of 2025 are not only outperforming expectations but also reshaping how investors view market leadership beyond Bitcoin. This shift reflects a maturing digital asset ecosystem where innovation, utility, and adoption are increasingly rewarded by capital flows.

For years, Bitcoin and Ethereum dominated headlines, but 2025 marked a turning point. A new generation of blockchain projects demonstrated that strong fundamentals, real-world use cases, and scalable infrastructure can drive extraordinary returns. As the top crypto gainers of 2025 emerged, they highlighted a broader trend of altcoin market momentum, signaling that investors are diversifying strategies and seeking value across multiple sectors of the crypto economy.

This article explores how the top crypto gainers of 2025 reflect deeper structural changes in the market. Drawing on insights aligned with Phoenix Group reports, it examines why altcoins surged, what factors fueled their performance, and what this momentum could mean for the future of digital assets. Rather than focusing on hype, this analysis emphasizes market dynamics, investor psychology, and long-term implications.

Understanding the context behind the top crypto gainers of 2025

The strong performance of the top crypto gainers of 2025 did not happen in isolation. It was the result of converging forces that reshaped the market environment. Macroeconomic stabilization, clearer regulatory signals in key regions, and growing institutional participation all contributed to renewed confidence in digital assets. Within this framework, altcoins benefited from being more agile and innovation-driven compared to established market leaders.

Phoenix Group reports emphasize that 2025 was characterized by selective capital allocation rather than broad-based speculation. Investors increasingly evaluated projects based on fundamentals such as network activity, developer engagement, and real-world adoption. This shift allowed high-quality altcoins to stand out and achieve exceptional growth, reinforcing the narrative of sustained altcoin season dynamics.

Altcoin momentum reshapes crypto market leadership

From Bitcoin dominance to diversified growth

One of the most notable trends highlighted by the top crypto gainers of 2025 is the gradual reduction in Bitcoin’s dominance. While Bitcoin remained a cornerstone of the market, capital increasingly flowed into altcoins offering differentiated value propositions. This diversification reflected a more sophisticated investor base that recognized opportunities beyond store-of-value narratives.

As altcoin momentum accelerated, sectors such as decentralized finance, layer-two scalability solutions, artificial intelligence integration, and tokenized real-world assets gained traction. The rise of these segments demonstrated that the crypto market is evolving into a multi-faceted ecosystem rather than a single-asset story.

Investor confidence and risk appetite

The success of the top crypto gainers of 2025 also points to growing investor confidence. Unlike previous cycles driven by speculative excess, 2025 saw a more measured risk appetite. Investors were willing to allocate capital to altcoins, but they demanded transparency, governance, and tangible progress. This disciplined approach helped sustain momentum and reduced the volatility traditionally associated with altcoin rallies.

Phoenix Group reports on emerging altcoin trends

Phoenix Group reports provide valuable insight into the structural trends that defined the top crypto gainers of 2025. According to their analysis, the most successful altcoins shared common characteristics, including strong community engagement, clear roadmaps, and alignment with broader technological trends. These factors contributed to consistent demand and long-term value creation.

The reports also highlight the role of institutional players, who increasingly view select altcoins as strategic investments rather than speculative bets. This institutional validation played a crucial role in legitimizing altcoin growth and reinforcing the narrative of crypto market maturation.

Key sectors driving the top crypto gainers of 2025

Decentralized finance regains momentum

Decentralized finance experienced a resurgence in 2025, driven by improved security, user experience, and regulatory clarity. Several top crypto gainers of 2025 emerged from this sector, reflecting renewed interest in permissionless financial infrastructure. Innovations in lending, derivatives, and cross-chain liquidity attracted both retail and institutional capital.

This revival demonstrated that DeFi is evolving beyond experimentation into a sustainable component of the global financial system. As a result, altcoins associated with robust DeFi ecosystems benefited from sustained demand and growing adoption.

Layer-two and scalability solutions lead innovation

Scalability remained a central challenge for blockchain networks, and 2025 saw significant progress in layer-two solutions. Projects addressing transaction speed, cost efficiency, and interoperability ranked among the top crypto gainers of 2025. Their success underscored the importance of infrastructure in supporting mass adoption.

Phoenix Group reports note that scalability-focused altcoins attracted long-term investors who recognized their role in enabling broader ecosystem growth. This infrastructure-driven momentum added depth and resilience to the altcoin market.

AI and data-driven blockchain applications

The integration of artificial intelligence with blockchain technology emerged as a defining theme in 2025. Altcoins leveraging AI for data analysis, automation, and predictive modeling achieved remarkable growth. These projects appealed to investors seeking exposure to cutting-edge innovation at the intersection of multiple transformative technologies.

The rise of AI-driven altcoins among the top crypto gainers of 2025 reflects a broader trend of convergence, where blockchain serves as a foundation for advanced digital applications.

Market psychology behind strong altcoin performance

Narrative shifts and investor perception

Market psychology played a significant role in shaping the top crypto gainers of 2025. As narratives shifted from speculative trading to long-term value creation, investor perception of altcoins evolved. Projects with compelling stories backed by measurable progress captured attention and capital.

This psychological shift reduced the boom-and-bust cycles that previously plagued altcoins. Instead, momentum was sustained by consistent development milestones and transparent communication, fostering trust and loyalty within communities.

The role of social consensus

Altcoin momentum in 2025 was also reinforced by social consensus within the crypto community. As Phoenix Group reports indicate, strong communities acted as catalysts for adoption and advocacy. This collective belief amplified network effects, driving usage and reinforcing price appreciation.

Liquidity, volume, and market structure

The top crypto gainers of 2025 benefited from improved market structure and deeper liquidity. Enhanced trading infrastructure, including better on-chain analytics and institutional-grade platforms, reduced friction and encouraged participation. Increased liquidity allowed prices to rise more organically, minimizing extreme volatility.

This structural improvement reflects a maturing market where altcoins can sustain growth without relying solely on speculative inflows. The result was a more stable environment conducive to long-term investment strategies.

Regulatory clarity and its impact on altcoin growth

Regulatory developments in 2025 provided greater clarity for digital asset markets, benefiting altcoins disproportionately. Clearer guidelines reduced uncertainty and encouraged innovation within compliant frameworks. Projects that proactively engaged with regulators gained credibility and attracted cautious investors.

Phoenix Group reports emphasize that regulatory alignment became a competitive advantage. Altcoins operating within transparent legal boundaries were better positioned to scale, contributing to their inclusion among the top crypto gainers of 2025.

Comparing 2025 to previous altcoin cycles

Unlike earlier cycles characterized by rapid speculation, the altcoin momentum of 2025 was more sustainable. The top crypto gainers of 2025 demonstrated resilience during market corrections, suggesting that their growth was supported by fundamentals rather than hype.

This contrast highlights a key evolution in the crypto market. Investors are increasingly discerning, and projects must deliver tangible value to maintain momentum. This shift bodes well for the long-term health of the altcoin ecosystem.

Long-term implications for investors

The emergence of strong altcoin momentum in 2025 has important implications for investors. Portfolio diversification across high-quality altcoins can enhance risk-adjusted returns, provided that due diligence remains rigorous. The success of the top crypto gainers of 2025 illustrates the potential rewards of identifying innovation early.

However, it also underscores the importance of risk management. Not all altcoins will sustain growth, and market cycles remain inevitable. A disciplined approach grounded in fundamentals is essential for navigating this evolving landscape.

The future outlook for altcoin momentum

Looking ahead, the trends that defined the top crypto gainers of 2025 are likely to persist. Continued technological innovation, institutional participation, and regulatory clarity will shape the next phase of altcoin development. While market conditions will fluctuate, the foundation laid in 2025 suggests a more resilient and diversified crypto ecosystem.

Phoenix Group reports conclude that altcoin momentum is no longer a temporary phenomenon but a structural feature of the market. This perspective reinforces the idea that digital assets are entering a new era of maturity and integration.

Conclusion

The top crypto gainers of 2025 highlight strong altcoin momentum that reflects deeper transformations within the cryptocurrency market. Supported by insights aligned with Phoenix Group reports, this trend demonstrates a shift toward fundamentals, innovation, and long-term value creation. Altcoins have moved beyond speculative sidelines to become central drivers of growth and experimentation.

As investors adapt to this evolving landscape, understanding the forces behind altcoin momentum becomes increasingly important. The lessons of 2025 suggest that the future of crypto will be shaped not by a single asset, but by a diverse ecosystem of interconnected projects pushing the boundaries of what blockchain technology can achieve.

FAQs

Q: What factors contributed to the top crypto gainers of 2025

The top crypto gainers of 2025 benefited from a combination of technological innovation, clearer regulation, and selective investor capital. Projects with strong fundamentals, active communities, and real-world use cases attracted sustained demand, allowing them to outperform the broader market.

Q: How do Phoenix Group reports explain strong altcoin momentum

Phoenix Group reports emphasize that altcoin momentum in 2025 was driven by structural changes rather than speculation. Improved infrastructure, institutional interest, and a focus on long-term value creation helped high-quality altcoins achieve consistent growth.

Q: Is altcoin momentum in 2025 sustainable in the long term

Altcoin momentum appears more sustainable than in previous cycles because it is supported by fundamentals and adoption. While market volatility will continue, the underlying trends suggest that leading altcoins are better positioned to withstand corrections and maintain relevance.

Q: How should investors approach the top crypto gainers of 2025

Investors should approach the top crypto gainers of 2025 with a balanced strategy that includes thorough research and risk management. Focusing on projects with clear roadmaps, transparent governance, and active development can help identify sustainable opportunities.

Q: What does strong altcoin momentum mean for the future of crypto markets

Strong altcoin momentum signals a more diversified and mature crypto market. It suggests that innovation and utility are becoming key drivers of value, paving the way for a broader range of blockchain applications and long-term growth across the digital asset ecosystem.