Cryptocurrency has gone from a niche experiment to a mainstream financial force, and with that growth has come a surge in fraud that is evolving faster than most people can keep up with. If you’ve been searching for cryptocurrency fraud trends statistics 2025, you’re likely trying to answer one pressing question: how big is the problem right now, and what does it mean for your money? The reality is that fraudsters are becoming more organized, more technical, and more psychologically sophisticated. They don’t just rely on obvious tricks anymore. They exploit hype cycles, social media influence, artificial intelligence, and the complexity of blockchain transactions to create scams that look legitimate even to experienced users.

In 2025, cryptocurrency fraud is no longer “just” about fake giveaways and shady coin launches. It’s about entire ecosystems of deception: deepfake videos of executives promoting fake investment platforms, highly targeted phishing campaigns that mimic real exchanges, malware designed to drain wallets silently, and professional-looking trading sites that trap deposits and block withdrawals. The numbers and trends reveal a clear pattern: as crypto adoption expands and as more financial products become tokenized, fraud moves right alongside it. People are still losing billions globally, and the fraud methods are diversifying across every major chain, social platform, and user type.

This article will walk you through cryptocurrency fraud trends statistics 2025 in a clear and practical way. You’ll learn what types of crypto fraud are dominating now, why the methods are changing, how scammers choose targets, and what you must do to protect yourself. The goal is not to scare you away from crypto, but to help you engage with it safely, intelligently, and with the right level of caution.

Cryptocurrency Fraud Trends Statistics 2025: The Big Picture

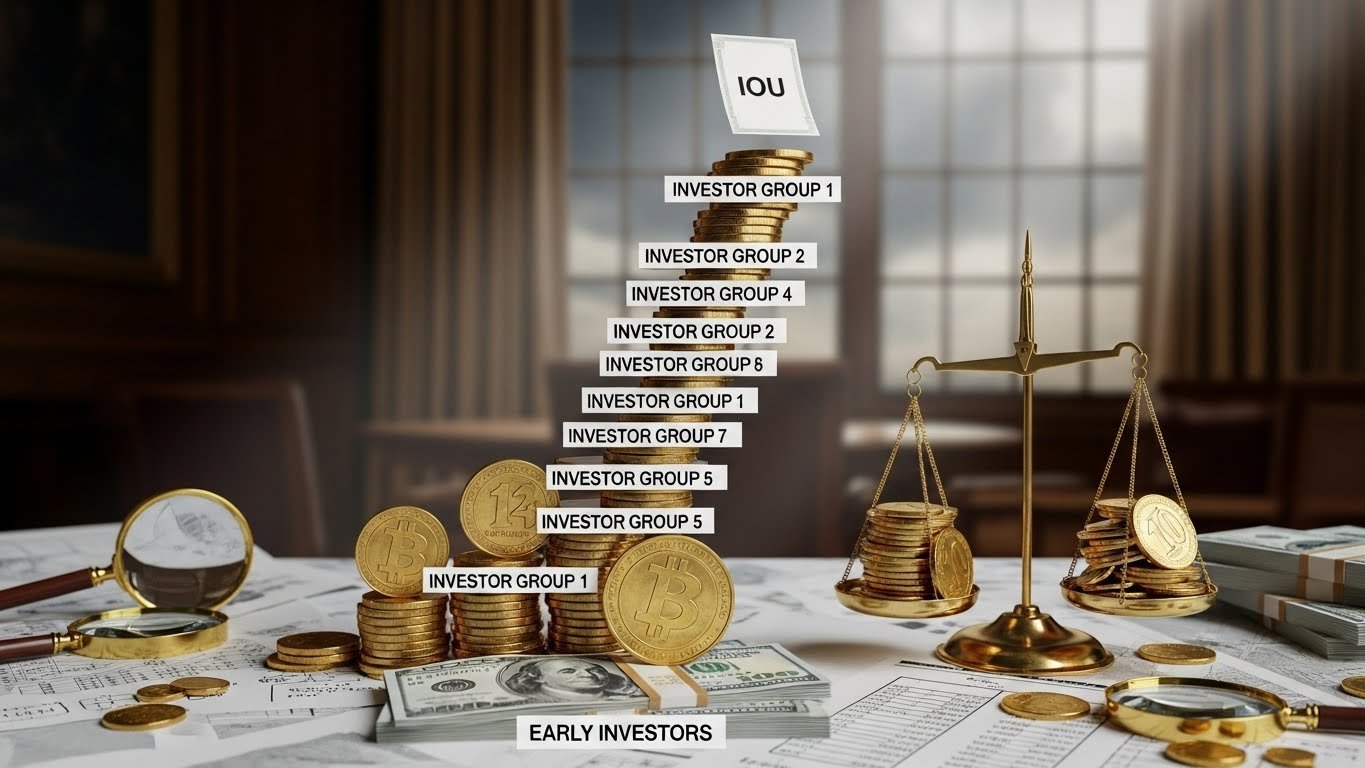

The most important thing to understand about cryptocurrency fraud trends statistics 2025 is that fraud is rising not only because there are more victims, but because scams are scaling. Fraud networks now operate like startups, complete with recruitment systems, marketing funnels, and customer support teams that “assist” victims while draining their funds. That level of organization is one reason fraud losses remain high even when markets cool down.

Another clear 2025 trend is that fraud is increasingly cross-platform. A victim might first encounter a scam on a social network, then be moved to an encrypted messaging app, then be directed to a fake exchange website, and finally be pressured into transferring assets through a wallet. Each step is designed to feel normal, and by the time the victim realizes something is wrong, the funds are long gone. Because blockchain transactions are typically irreversible, this creates a perfect environment for fraudsters.

At the same time, the perception of crypto fraud is changing. It’s no longer seen as a problem limited to beginners. Experienced traders, NFT collectors, DeFi users, and even corporate teams handling digital assets are increasingly targeted. In many cases, the goal is not to steal a small amount from many people, but to extract a large sum from fewer targets through social engineering and carefully staged “investment opportunities.”

Why Crypto Fraud Is Growing in 2025

Cryptocurrency fraud trends statistics 2025 are shaped by a few powerful drivers that make crypto uniquely attractive to criminals. The first is speed. Crypto moves faster than traditional banking, which makes it easier to steal and harder to trace in time. The second is global reach. A scammer can run a fraud operation from almost anywhere and target victims across multiple countries at once. The third is the psychological environment. Crypto still carries an aura of high returns, early access, and secret opportunities, which scammers exploit relentlessly.

A major driver in 2025 is the rise of AI-assisted crime. Scammers can now generate convincing content at scale: fake websites, fake customer service chat, fake press releases, and fake influencer endorsements. Deepfake technology is also being used to impersonate founders, customer support agents, and public figures. This makes traditional “trust signals” less reliable. People who once relied on video proof or professional branding are now discovering that those cues can be fabricated.

In addition, crypto infrastructure has become more complex. The average user now interacts with exchanges, wallets, bridges, staking platforms, and DeFi protocols. Each additional touchpoint creates another opportunity for fraud. Complexity increases the chance of a mistake, and scammers design their traps around that.

Most Common Cryptocurrency Fraud Types in 2025

Cryptocurrency fraud trends statistics 2025 show that scams are not random. Certain categories consistently dominate because they are profitable and scalable. Understanding these scam types is the first step to recognizing them quickly.

Investment Scams and Fake Trading Platforms

Fake investment platforms remain one of the most damaging forms of crypto fraud in 2025. They often promise stable daily profits, “AI trading bots,” or insider access to early token launches. The platform may show fake charts, fake balances, and even allow small withdrawals early on to build trust. Once a victim deposits more, withdrawals suddenly “fail,” and customer support demands additional payments to unlock funds, such as taxes, verification fees, or liquidity charges.

These scams rely on Ponzi-style mechanics and the emotional pull of consistent gains. Victims are often encouraged to reinvest rather than withdraw, which increases losses. In 2025, these platforms also use synthetic reviews and AI-generated endorsements to look legitimate.

Phishing and Wallet Draining Attacks

Phishing has evolved sharply. It is no longer limited to bad spelling and suspicious emails. In 2025, phishing campaigns are highly polished and targeted. Scammers mimic real exchanges and wallet providers, using clone domains, identical design elements, and convincing customer service chat windows. Victims are tricked into entering seed phrases or approving malicious transactions.

A major trend is “wallet draining” through smart contract approvals. Instead of stealing a seed phrase, scammers trick users into signing a transaction that grants permission to move tokens. Once the approval is given, the wallet can be emptied without further interaction. This is common in fake NFT mint sites, fake airdrops, and fake staking dashboards. These attacks thrive because users often don’t fully understand what they are signing. In a world of multi-chain wallets, token approvals, and DeFi contracts, one mistaken click can be enough.

Romance Scams and Pig Butchering

Romance scams remain a devastating problem and are a major part of cryptocurrency fraud trends statistics 2025. A scammer builds a relationship over weeks or months, then introduces an “amazing crypto investment opportunity.” Often this is a fake trading platform that shows profits and encourages larger deposits. The victim believes they are investing with a trusted partner, making the emotional manipulation extremely powerful. Pig butchering scams are particularly dangerous because they use psychological pressure and long-term grooming rather than quick tricks. Victims often lose life savings. In 2025, these scams increasingly involve teams of scammers, scripted conversations, and AI-generated messaging to scale operations.

Rug Pulls and Token Manipulation

Rug pulls are still common in 2025, especially in smaller token ecosystems where launching a coin is easy and marketing is fast. A rug pull usually involves creators hyping a token, attracting liquidity, and then draining the liquidity pool, causing the price to collapse. In some cases, the developers disappear. In other cases, they rebrand and launch again.

This fraud category is fueled by hype culture and FOMO. The scam succeeds when investors chase fast gains without checking token distribution, contract permissions, and liquidity lock details. Because new tokens appear daily, the scam environment renews itself constantly.

NFT Fraud and Marketplace Deception

NFT fraud has matured. It’s not just fake collections, but fake partnerships, fake grants, and marketplace impersonation. Scammers now exploit trust in recognizable brands by creating lookalike NFT drops that appear “official.” They also target collectors with phishing messages disguised as royalty payments or verification requirements. In 2025, NFT scams also overlap with wallet draining more than ever. A fake mint site isn’t trying to sell art. It’s trying to steal the wallet.

Cryptocurrency Fraud Trends Statistics 2025: Who Is Being Targeted?

One of the most revealing insights from cryptocurrency fraud trends statistics 2025 is that scammers are adapting to target different user segments. Beginners still get hit by simple scams, but advanced users are now targeted through more technical attacks, including malicious smart contracts, fake developer tools, and compromised browser extensions.

High-net-worth crypto holders are increasingly targeted with tailored approaches that include personal research, identity impersonation, and “exclusive” investment deals. Meanwhile, everyday users are targeted through mass-scale social media scams and fake support channels. Fraudsters often focus on times when emotions are high, such as during major bull runs, sudden market drops, or highly publicized token launches. Scammers also exploit cultural and language patterns. Many operations now create regional versions of scams to appear more local and believable. They use localized customer support, region-specific payment methods, and familiar influencer styles.

The Role of Social Media and Influencers in 2025 Crypto Fraud

Social media is one of the most powerful engines behind crypto fraud in 2025. Scammers use short-form video, live streams, and comment manipulation to create artificial credibility. They may flood posts with bots praising a project, or they may hijack real accounts to promote scams.

A growing trend is influencer impersonation. Scammers copy a creator’s style, profile image, and name, then message followers with “exclusive” giveaways or early access token deals. In other cases, scammers run ads that look like legitimate endorsements. Because attention moves quickly online, victims often act before verifying. This is why social engineering remains the core of crypto fraud. The technical side matters, but the manipulation is what drives people to make irreversible transactions.

How AI and Deepfakes Are Changing Crypto Fraud

If 2024 introduced many people to AI-generated deception, 2025 is when it becomes mainstream in crypto scams. Deepfakes are used to fabricate videos of well-known personalities endorsing platforms. AI voice cloning can simulate a friend, a colleague, or a customer support representative. AI-written chat scripts make scammers sound calm, professional, and consistent.

The result is a trust crisis. Traditional online safety advice like “check the quality of the content” is no longer enough. A scam can look and sound perfect. That’s why cryptocurrency fraud trends statistics 2025 emphasize verification through independent channels, not surface-level appearances.

AI also helps scammers automate. They can run multiple conversations simultaneously, rapidly test different approaches, and adjust messaging based on victim responses. This makes fraud faster and more adaptive than before.

Emerging Crypto Fraud Hotspots: DeFi, Bridges, and Staking

Crypto fraud is shifting toward where money moves. In 2025, that includes DeFi, cross-chain bridges, and staking platforms. DeFi scams often involve fake yield farms, manipulated smart contracts, and phishing attacks disguised as protocol updates. Bridges are especially vulnerable because they involve complex transactions and often require users to trust new interfaces.

Staking scams are also rising. Fraudsters create fake staking portals that mimic real platforms and ask users to connect wallets. The interface then requests approvals that drain assets. Other staking scams involve fake validators or fake “locked staking” programs that never allow withdrawals. Because these areas are technical, they create a knowledge gap. Scammers exploit that gap, knowing many users will not read contract details or understand permissions.

Warning Signs You Should Never Ignore

The patterns behind cryptocurrency fraud trends statistics 2025 show that scams leave clues. Even advanced scams rely on urgency, secrecy, and emotional pressure. If someone tells you an opportunity is limited, confidential, or guaranteed, that is a major red flag. If a platform demands extra money to unlock withdrawals, that is almost always fraud.

Another warning sign is unusual communication channels. Real exchanges and reputable projects rarely resolve serious issues through random direct messages. Scam operations often push victims into private chats to reduce accountability and isolate them from outside advice. Also pay attention to technical red flags. Requests for seed phrases, unusual wallet approval prompts, and unexpected transaction requests should immediately trigger caution. A legitimate platform will never ask for your seed phrase, and a normal login process should not require signing unusual transactions.

How to Protect Yourself from Cryptocurrency Fraud in 2025

Protection in 2025 requires both mindset and tools. A safe approach starts with slowing down. Most fraud succeeds because victims act quickly. If you pause, verify, and consult independent sources, you break the scam’s momentum. You should secure your wallet properly using hardware wallets where possible and avoid keeping large balances in hot wallets. Use two-factor authentication on exchanges and avoid reusing passwords. Be cautious about browser extensions and only install trusted wallet tools. Keep software updated, because many scams involve exploiting outdated security.

In 2025, it’s also essential to understand approvals. Before signing transactions, read what permissions you’re granting. If you don’t understand it, don’t sign it. A major part of modern fraud is not stealing keys but convincing you to grant access. You should also separate your crypto activity into layers. Use a smaller wallet for day-to-day interactions and keep long-term holdings in a more secure wallet that rarely connects to websites. This reduces damage if something goes wrong.

What to Do If You’ve Been Scammed

If you suspect you’ve been scammed, act immediately. Disconnect your wallet from any sites you connected to and move remaining funds to a new secure wallet if you can do so safely. Change passwords, enable stronger security, and document everything. Save transaction IDs, chat logs, emails, screenshots, and platform details. Reporting matters even if recovery is uncertain. While crypto transactions are hard to reverse, reporting increases the chance that investigators can track patterns, shut down fraudulent platforms, or intercept funds before they disappear through mixers and cross-chain swaps.

Emotionally, it’s also important to understand that crypto fraud is designed to manipulate. Victims often feel shame, but the scammers are professionals who use psychological tactics. Seeking help quickly can prevent additional losses, especially if scammers attempt follow-up extortion.

The Future of Cryptocurrency Fraud Beyond 2025

The trajectory suggested by cryptocurrency fraud trends statistics 2025 indicates that fraud will remain a constant threat as long as crypto grows. However, the nature of the threat will continue to evolve. We are likely to see more AI-driven personalization, more attacks against institutions, and more hybrid scams that combine identity theft with crypto theft.

At the same time, the security ecosystem is also improving. Wallet technology is advancing, detection tools are becoming smarter, and regulators are paying closer attention. User education will remain one of the most effective defenses, because even the best tools can be defeated if a user is tricked into approving a malicious transaction. In other words, the battle is ongoing. Crypto is powerful, but it demands responsibility. The winners in 2025 and beyond will be the users who understand how fraud works and build habits that make them difficult targets.

Conclusion

Cryptocurrency fraud trends statistics 2025 point to a clear reality: crypto fraud is growing in sophistication, scale, and emotional manipulation. The scams that dominate today are no longer always obvious, and they often look like legitimate platforms, real endorsements, or trusted relationships. The combination of AI content, deepfake technology, and multi-platform social engineering is creating a more dangerous environment than ever before.

The best response is not panic, but preparation. Learn the dominant scam types, understand how wallet approvals work, verify everything through independent channels, and build security layers into how you store and use crypto. In 2025, staying safe is not about being paranoid. It’s about being informed, cautious, and hard to fool. If you treat every transaction like it matters, you’ll be far less likely to become part of the next set of cryptocurrency fraud trends statistics 2025.

FAQs

Q: What are the most alarming cryptocurrency fraud trends statistics 2025 that everyday users should understand before investing?

The most alarming cryptocurrency fraud trends statistics 2025 are the rise of highly organized investment scams, the explosion of phishing and wallet-draining attacks, and the increased use of AI-driven deception. Everyday users should understand that scammers now build fake trading platforms that look professional, use social engineering to pressure victims into quick decisions, and exploit technical confusion around approvals and smart contracts. What makes 2025 especially risky is that scams often begin on social media and move into private chats, creating a controlled environment where victims feel guided, supported, and confident until the money disappears.

Q: How can I tell the difference between a real exchange support message and a crypto scam in 2025?

In 2025, scammers mimic real support channels extremely well, so the difference often comes down to behavior rather than appearance. Real exchanges rarely initiate contact through direct messages, and they will never ask for your seed phrase or request that you sign transactions to “verify” your account. Fraudsters often create urgency, claim your funds are at risk, or say you must act immediately to avoid a freeze. If the support agent pushes you to move funds to a “safe wallet,” pay a fee to unlock withdrawals, or share private security details, it’s almost certainly a scam. Verification through official channels you access independently is your safest method.

Q: Why are AI and deepfakes making cryptocurrency fraud trends statistics 2025 worse than previous years?

AI and deepfakes make cryptocurrency fraud trends statistics 2025 worse because they remove the traditional signals people used to rely on for trust. A scammer can generate professional websites, convincing customer service chat, and even realistic videos of trusted personalities endorsing a fake platform. Deepfake technology also enables impersonation in a way that feels emotionally real, especially when combined with voice cloning and scripted persuasion. This increases the number of victims because the scams appear credible, and it increases the average loss because victims are more likely to invest larger amounts when they believe the endorsement or relationship is real.

Q: What is the safest way to use DeFi and staking platforms in 2025 without falling into crypto fraud traps?

The safest way to use DeFi and staking platforms in 2025 is to treat every connection and transaction as a potential security risk. Use a separate wallet for DeFi activity and keep your main holdings in a more secure wallet that rarely connects to websites. Always verify you are on the correct domain, be cautious about pop-ups requesting approvals, and avoid signing transactions you do not fully understand. Many modern scams do not need your seed phrase because they rely on approval permissions that let scammers drain your wallet later. Regularly reviewing and limiting permissions, keeping software updated, and avoiding unverified “high yield” opportunities greatly reduces your risk.

Q: If someone has already been scammed, what immediate steps can they take to prevent further crypto losses and emotional manipulation?

If someone has been scammed, the first step is to stop communicating with the scammer immediately, because many fraud operations attempt follow-up extortion or “recovery scams.” Next, disconnect the wallet from any suspicious sites and move remaining funds to a new secure wallet if possible. Change passwords, enable strong authentication, and document everything including transaction IDs and chat messages. Reporting the incident can help prevent others from being victimized and may support investigations. Emotionally, victims should understand that crypto fraud is built on manipulation and shame, so seeking support quickly is crucial to prevent panic-driven mistakes that can lead to even larger losses.