Cryptocurrency has moved from the margins of finance to the center of global economic debate. What began as a niche experiment in peer-to-peer value transfer has developed into a complex ecosystem of digital assets, exchanges, decentralized finance tools, stablecoins, tokenized securities, and blockchain-based applications. As adoption grows, governments and regulators face a pressing challenge: how to design cryptocurrency regulation that promotes innovation, protects consumers, prevents illicit activity, and preserves financial stability. The urgency is amplified by cross-border transactions, rapidly evolving technology, and the growing integration of digital assets into traditional financial systems.

Global trends in cryptocurrency regulation and policy evolution now reflect a world in transition. Some jurisdictions are building comprehensive frameworks to welcome blockchain innovation, while others are taking a cautious approach, prioritizing strict controls and enforcement. Many countries are still experimenting, balancing risks such as money laundering, tax evasion, fraud, and market manipulation against potential benefits such as financial inclusion, efficient payments, capital market innovation, and new forms of fundraising. The resulting landscape is fragmented, dynamic, and full of regulatory uncertainty.

This sample grant proposal focuses on understanding the global trends in cryptocurrency regulation and policy evolution through systematic research. The proposed work aims to analyze regulatory models across regions, track shifts in policy direction, identify emerging compliance standards, and assess impacts on innovation and market behavior. By synthesizing lessons from leading jurisdictions and developing comparative insights, this project supports policymakers, industry participants, and researchers seeking evidence-based approaches to governing digital assets. With financial regulation, digital asset compliance, and crypto policy frameworks evolving rapidly, the need for rigorous analysis has never been greater.

Background and Rationale

The rise of cryptocurrency regulation is rooted in the growing scale and influence of digital asset markets. As cryptocurrencies gained mainstream attention, so did their associated risks. Early policy debates were dominated by concerns about anonymity and illicit use, but modern regulatory discussions now address wider issues: investor protection, systemic risk, market integrity, cybersecurity, and the governance of stablecoins. The evolution of crypto markets from simple token trading to complex decentralized finance (DeFi) platforms has also expanded the scope of regulatory oversight.

At the same time, governments recognize that blockchain technology can generate economic opportunity. Many countries are competing to attract crypto startups, create innovation hubs, and build talent pipelines in cryptography and distributed systems. This creates a policy tension: overly restrictive approaches may push innovation offshore, while overly permissive approaches may expose markets to fraud, consumer harm, and instability. The outcome is a diverse patchwork of cryptocurrency regulation approaches, often influenced by domestic economic priorities and geopolitical considerations.

The rationale for this proposed research is based on a critical gap: while there is extensive commentary on cryptocurrency regulation, there is less structured, comparative research that maps global policy evolution over time, identifies which regulatory strategies are most effective, and explains why different models emerge. In addition, regulatory language and definitions vary across jurisdictions, making it difficult to compare frameworks. By providing a unified analytical lens, this project will improve understanding of global trends in cryptocurrency regulation and policy evolution, helping stakeholders anticipate regulatory shifts and design better compliance and governance strategies.

Problem Statement

Despite growing regulatory activity, cryptocurrency regulation remains inconsistent and fragmented globally. Some jurisdictions provide detailed licensing rules for exchanges and custodians, while others rely on enforcement-only strategies or interpret crypto activity under existing securities, commodities, or payments laws. This inconsistency creates uncertainty for businesses operating across borders and complicates consumer protection.

A core challenge is the mismatch between national legal systems and borderless crypto networks. Digital asset transactions can occur across multiple jurisdictions simultaneously, and centralized intermediaries often serve global customers. Meanwhile, decentralized protocols may lack a single identifiable operator, raising questions about accountability, enforcement, and governance. As policy evolution accelerates, regulators struggle to keep pace with technical innovation, leading to reactive rules, shifting guidance, and occasional regulatory arbitrage.

This proposal addresses these problems by investigating global trends in cryptocurrency regulation and policy evolution through a structured, comparative approach. The project aims to clarify how countries define crypto assets, regulate intermediaries, address DeFi risks, tax crypto activities, and coordinate with international standard-setting bodies. Ultimately, the research will provide policymakers and industry leaders with actionable insights to build more coherent and effective digital asset governance.

Project Goals and Objectives

The primary goal of this grant proposal is to conduct a comprehensive study of global trends in cryptocurrency regulation and policy evolution, producing research outputs that improve regulatory clarity, encourage responsible innovation, and support evidence-based decision-making.

The objectives include developing a comparative framework for analyzing cryptocurrency regulation across jurisdictions, identifying key trends and drivers behind policy shifts, and documenting best practices for balancing innovation and risk management. The research will also assess the impact of regulatory choices on market participation, investment flows, and consumer outcomes. In addition, the project will explore harmonization possibilities, including alignment with AML/KYC standards, cross-border cooperation models, and the role of international organizations in shaping crypto policy.

By focusing on both established financial markets and emerging economies, the project will provide a broad perspective on policy evolution. The outputs will be designed for practical use, including policy briefs, research reports, and stakeholder workshops. These objectives align with the increasing need for a shared understanding of cryptocurrency regulation trends as digital assets become more embedded in the global financial system.

Research Questions and Scope

The research will center on several key questions that define the global trends in cryptocurrency regulation and policy evolution. One question concerns classification: how do different jurisdictions define cryptocurrencies, stablecoins, security tokens, and utility tokens, and how do these definitions shape regulatory outcomes? Another question addresses regulation of intermediaries: what licensing, capital requirements, custody rules, and consumer protection measures apply to exchanges, brokers, and custodians?

A major focus will be on enforcement and compliance. How are anti-money laundering (AML) obligations implemented for digital assets, and how do regulators treat privacy coins and mixer services? The project will also analyze taxation, including how countries treat crypto capital gains, mining income, staking rewards, and token airdrops.

The scope includes the regulation of decentralized finance, which is a rapidly evolving domain. Research will investigate how policymakers are responding to DeFi’s unique characteristics, including protocol governance, smart contract risk, liquidity pools, and decentralized exchanges. Additionally, the study will explore central bank digital currency (CBDC) initiatives and how they interact with cryptocurrency regulation, especially where governments see CBDCs as a policy tool to counter or complement private crypto assets.

Literature Review and Policy Context

The academic and policy literature on cryptocurrency regulation highlights recurring themes: the trade-off between innovation and risk, the challenge of cross-border enforcement, and the difficulty of applying legacy legal categories to new technologies. Many studies emphasize that regulatory clarity encourages investment and legitimate industry growth, while unclear or overly punitive approaches may create shadow markets and reduce consumer protection.

Policy reports from financial regulators often prioritize market integrity and investor safeguards, focusing on disclosure standards, exchange oversight, and the prevention of manipulation. Meanwhile, discussions of financial stability increasingly include stablecoins due to their potential impact on payments and liquidity. The role of international standard-setters has expanded, shaping compliance expectations and influencing how countries design their cryptocurrency regulation frameworks.

This project builds on these insights but adds a distinctive comparative and longitudinal dimension. By tracking policy evolution over time and across regions, the research will identify not only what rules exist, but also why they changed and what outcomes followed. This deeper context is essential for understanding global trends in cryptocurrency regulation and policy evolution in a way that supports smarter policymaking.

Methodology

The project will use a mixed-methods research approach to study cryptocurrency regulation and policy evolution. The first phase will involve legal and policy mapping. Researchers will collect regulatory texts, guidance documents, enforcement actions, and official statements from a representative sample of jurisdictions. These materials will be coded using a standardized framework to enable cross-country comparisons.

The second phase will involve qualitative analysis through expert interviews with regulators, compliance professionals, legal scholars, and crypto industry leaders. These interviews will clarify policy intent, enforcement challenges, and the practical impact of rules. The third phase will incorporate quantitative indicators, such as market participation trends, exchange licensing numbers, compliance cost estimates, and crypto adoption measures, to assess outcomes linked to regulatory approaches.

A key innovation will be the creation of a “policy evolution timeline” that tracks major regulatory milestones and shifts in each jurisdiction. This timeline will allow the research team to identify patterns, such as increased regulation after market crashes, stricter rules following major fraud cases, or supportive frameworks emerging to attract investment. The methodology will ensure that findings on global trends in cryptocurrency regulation and policy evolution are evidence-based and actionable.

Work Plan and Deliverables

The work plan will be structured over a defined project period, beginning with data collection and framework design. Early work will focus on building the comparative regulatory database, ensuring consistent coding and classification. The project will then move into deeper analysis and interviews, followed by synthesis and publication.

Deliverables will include a comprehensive research report on global trends in cryptocurrency regulation and policy evolution, detailing regional models and comparative insights. The project will produce policy briefs tailored to different audiences, including policymakers, regulators, and private sector compliance teams. It will also generate an analytical toolkit that can be used to assess regulatory readiness and predict likely policy shifts based on observed patterns.

Workshops and stakeholder sessions will help disseminate findings and encourage dialogue. These sessions will highlight best practices, explore harmonization opportunities, and provide guidance for responsible crypto innovation. The deliverables are designed to be accessible, practical, and impactful, supporting both immediate decision-making and longer-term strategic planning.

Key Global Trends in Cryptocurrency Regulation

The Shift from Uncertainty to Framework-Based Regulation

One of the clearest global trends in cryptocurrency regulation and policy evolution is the transition from ambiguity to more formal frameworks. In earlier years, many governments relied on general warnings and ad hoc enforcement. Today, more jurisdictions are implementing structured licensing regimes for exchanges and custodians, often requiring consumer protection measures, cybersecurity standards, and operational transparency.

This trend reflects both market maturity and the realization that banning or ignoring crypto activity is rarely effective. Framework-based regulation aims to bring digital assets into the regulated economy, improving oversight while enabling legitimate businesses to operate. This transition is shaping the global policy narrative, encouraging convergence around certain baseline compliance expectations.

The Expansion of AML and Travel Rule Requirements

The spread of strict AML/KYC standards is another major trend. Regulators increasingly require exchanges and service providers to verify customer identities, monitor transactions, and report suspicious activity. Many jurisdictions are also implementing Travel Rule-style requirements, requiring the sharing of originator and beneficiary information for certain transfers.

These measures are central to global trends in cryptocurrency regulation and policy evolution because they represent a global push to align crypto with traditional financial compliance expectations. While these rules can improve security and reduce illicit activity, they also raise debates about privacy, feasibility, and enforcement in decentralized environments.

Stablecoin Regulation as a Policy Priority

Stablecoins have become a focal point in policy evolution due to their potential role in payments, remittances, and cross-border settlements. Governments are increasingly concerned about stablecoin reserve quality, redemption rights, operational resilience, and systemic risk. As stablecoins can scale quickly, regulators often view them as requiring stronger oversight than many other crypto assets.

The regulatory treatment of stablecoins is therefore a defining feature of global trends in cryptocurrency regulation and policy evolution. Some jurisdictions are creating specialized stablecoin regimes, while others regulate them under payments law or securities rules, depending on their design and usage.

DeFi and the Challenge of Decentralized Governance

DeFi has introduced a new regulatory frontier. Unlike centralized exchanges, many DeFi protocols lack clear intermediaries, relying instead on smart contracts and community governance. Regulators are exploring how to define responsibility, apply consumer protection, and enforce compliance without undermining decentralized innovation.

This challenge is central to global trends in cryptocurrency regulation and policy evolution because it forces a rethinking of regulatory assumptions. Traditional frameworks rely on identifiable parties and licensing, but DeFi often distributes control across token holders and developers. Policy responses will shape the future of decentralized finance and influence where innovation clusters globally.

Regional Comparison of Regulatory Models

North America: Enforcement and Structured Oversight

In North America, policy evolution is shaped by strong enforcement traditions, a focus on investor protection, and complex jurisdictional overlaps between agencies. The regulatory environment often involves applying existing securities and commodities laws to crypto assets, while also building more crypto-specific guidance. This approach has pushed many market participants to prioritize compliance, legal clarity, and robust risk management.

The North American model influences global trends in cryptocurrency regulation and policy evolution because of the region’s financial prominence. Regulatory actions often set global expectations, affecting how exchanges and token issuers operate internationally. At the same time, debates continue over how to define crypto assets consistently and how to support innovation without sacrificing consumer safeguards.

Europe: Harmonization and Comprehensive Frameworks

Europe’s defining characteristic is its effort to harmonize cryptocurrency regulation across multiple countries. Rather than relying solely on enforcement, European policy evolution increasingly involves unified rules for licensing, consumer protection, and stablecoin oversight. This model aims to reduce fragmentation and provide predictable compliance requirements.

The European approach contributes strongly to global trends in cryptocurrency regulation and policy evolution because it demonstrates how cross-border regulatory alignment can support both innovation and consumer safety. Harmonization also makes the region attractive for businesses seeking consistency across multiple markets under a single regulatory framework.

Asia: Innovation Hubs and Controlled Growth

Asia presents a diverse regulatory landscape. Some jurisdictions encourage crypto innovation through sandbox models, clear licensing, and supportive tax policies. Others take a more restrictive stance, concerned about capital flight, consumer risk, and financial stability. The result is a region where policy evolution often reflects broader national economic strategies.

This diversity makes Asia a key focus for understanding global trends in cryptocurrency regulation and policy evolution. The region’s large populations and active crypto markets mean that regulatory decisions can rapidly influence global adoption patterns, innovation flows, and cross-border capital movement.

Emerging Markets: Financial Inclusion and Risk Management

In emerging markets, cryptocurrency regulation is often shaped by the realities of inflation, limited banking access, and high remittance costs. Some governments see crypto as a tool for financial inclusion, while others fear it could undermine monetary sovereignty or facilitate illicit flows.

Policy evolution in these markets often involves balancing innovation with macroeconomic stability. Understanding global trends in cryptocurrency regulation and policy evolution requires analyzing how emerging economies adapt regulatory tools to local constraints, sometimes creating unique hybrid approaches that differ from those in wealthier jurisdictions.

Expected Impact and Significance

The proposed research will deliver meaningful benefits for multiple stakeholders. Policymakers will gain comparative insights into how different regulatory models perform, helping them design more effective cryptocurrency regulation frameworks. Regulators will benefit from evidence-based strategies for addressing AML compliance, stablecoin oversight, and DeFi risks.

Industry participants will gain a clearer view of global trends in cryptocurrency regulation and policy evolution, enabling them to improve compliance planning, manage cross-border risks, and reduce exposure to regulatory uncertainty. Researchers and civil society organizations will benefit from accessible findings that inform public debate and promote transparency.

Beyond immediate outputs, the project supports long-term goals: building safer markets, reducing fraud, encouraging responsible innovation, and improving international coordination. As digital assets continue to evolve, this research will help ensure that policy evolution is proactive rather than reactive, guiding regulation toward fairness, efficiency, and resilience.

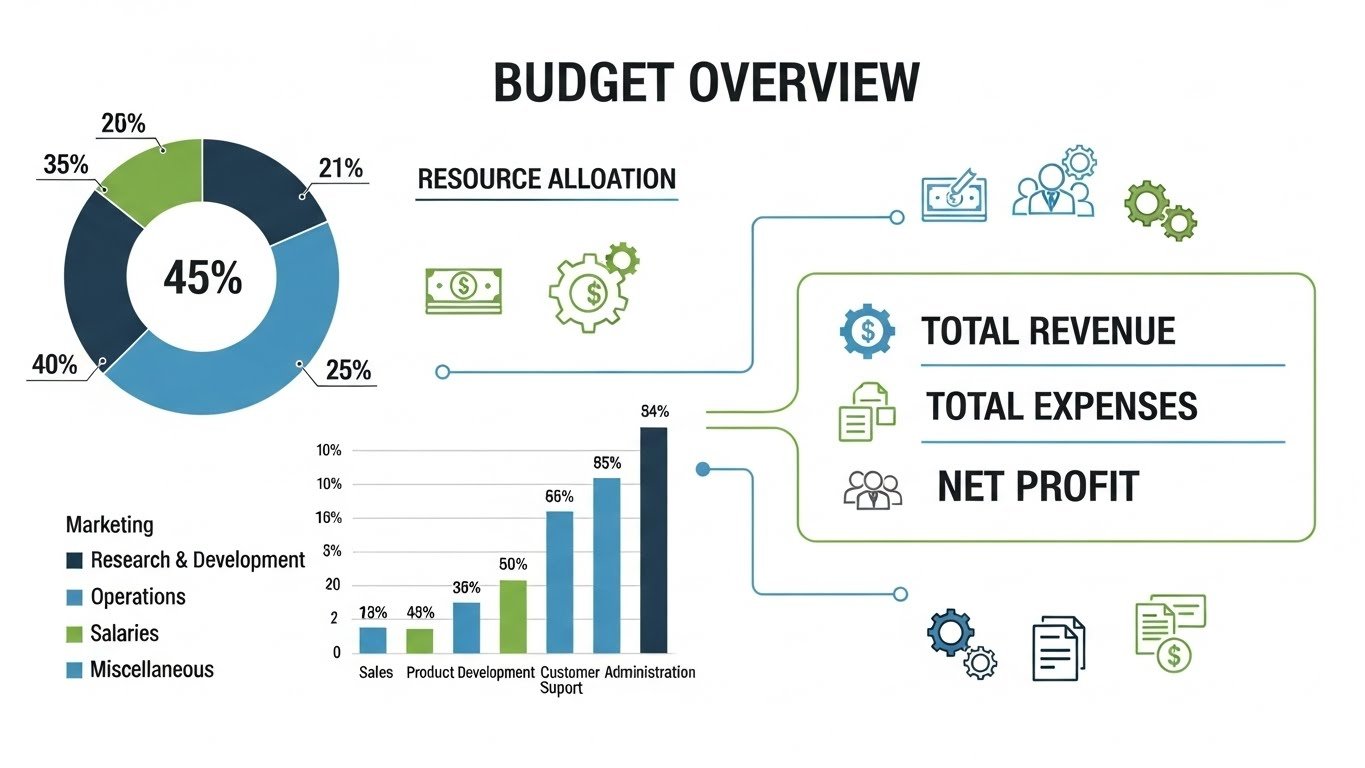

Budget Overview and Resource Allocation

The project budget will prioritize research capacity, data collection infrastructure, and dissemination activities. Funding will support personnel costs for researchers, legal analysts, and policy experts. It will also cover data acquisition, translation of regulatory materials where necessary, and secure storage of collected documents. Interview and stakeholder engagement costs will be included, ensuring the project captures practical realities alongside formal legal analysis. Resources will also be allocated for publishing and distributing reports, hosting workshops, and developing toolkits that policymakers and industry participants can use.

This allocation ensures the grant supports a robust study of global trends in cryptocurrency regulation and policy evolution, producing outputs with real-world impact. The budget will be managed transparently, with clear reporting mechanisms and measurable milestones.

Sustainability and Future Expansion

The project will be designed for sustainability beyond the grant period. The regulatory database and policy evolution timeline will be structured as living resources that can be updated as new rules emerge. Partnerships with academic institutions, policy organizations, and industry bodies will support ongoing refinement and broader reach.

Future expansion could include deeper coverage of sector-specific regulation, such as NFTs, tokenized real-world assets, and blockchain-based identity systems. The research framework could also be adapted for regional capacity-building, supporting regulators in developing countries who may lack specialized crypto expertise. By building durable research infrastructure, the project ensures that insights into cryptocurrency regulation and policy evolution remain relevant, supporting long-term improvements in global digital asset governance.

Conclusion

Global trends in cryptocurrency regulation and policy evolution reveal a world grappling with a transformational technology. As digital assets become more integrated into finance, governments are moving from uncertainty and fragmented enforcement toward more structured regulatory frameworks. The evolution is driven by key priorities: consumer protection, market integrity, financial stability, and the need to prevent illicit activity while still encouraging innovation.

This sample grant proposal outlines a comprehensive research initiative to analyze and compare cryptocurrency regulation globally, track policy changes over time, and identify best practices for effective governance. By producing rigorous comparative insights and practical outputs, the project supports policymakers, regulators, and industry leaders seeking to navigate an increasingly complex regulatory landscape. Ultimately, understanding global trends in cryptocurrency regulation and policy evolution is essential for building safer markets, fostering responsible innovation, and ensuring that the future of digital finance is both inclusive and resilient.

FAQs

Q: How do global trends in cryptocurrency regulation affect crypto investors and everyday users?

Global trends in cryptocurrency regulation affect investors and everyday users by shaping the safety, transparency, and accessibility of digital asset markets. When cryptocurrency regulation strengthens investor protection, it can reduce scams, improve exchange accountability, and make dispute resolution more practical for users. At the same time, stricter compliance rules may increase onboarding requirements, requiring identity verification and transaction monitoring that some users find intrusive. Policy evolution also influences which crypto services can legally operate in a country, so changes can affect whether people can access exchanges, stablecoins, staking programs, or DeFi platforms. Overall, better-aligned regulation can increase confidence, but uneven global policies may still expose users to uncertainty.

Q: Why is stablecoin regulation considered a major part of policy evolution in digital assets?

Stablecoin regulation has become a central part of policy evolution because stablecoins are designed to function like digital cash while operating globally and potentially at massive scale. If a stablecoin is widely used for payments and settlements, it can impact financial stability, monetary policy transmission, and liquidity in traditional markets. Regulators worry about reserve quality, redemption guarantees, operational risk, and governance failures, especially during market stress. As a result, stablecoin oversight is evolving faster than many other parts of cryptocurrency regulation, with many jurisdictions creating specialized rules that resemble banking, payments, or securities supervision depending on how stablecoins are structured and marketed.

Q: What makes decentralized finance harder to regulate than centralized crypto exchanges?

Decentralized finance is harder to regulate because it often lacks a centralized operator that can be licensed or held accountable under traditional frameworks. Centralized exchanges have identifiable management, corporate structures, and physical locations, making regulation and enforcement more straightforward. In DeFi, smart contracts can execute transactions automatically, governance may be distributed among token holders, and developers may not have direct control after deployment. This creates uncertainty around who is responsible for compliance obligations such as AML requirements, consumer disclosures, and risk management. As a result, policy evolution in this area involves experimenting with new approaches that address technology-specific realities without eliminating the benefits of decentralization.

Q: How can countries reduce regulatory arbitrage while still supporting crypto innovation?

Countries can reduce regulatory arbitrage by coordinating minimum standards for cryptocurrency regulation, especially in areas like licensing, AML compliance, consumer protection, and stablecoin reserve transparency. When jurisdictions align on baseline expectations, it becomes harder for bad actors to simply relocate to avoid oversight. However, supporting innovation requires flexibility, such as regulatory sandboxes, clear guidance, and proportional requirements that do not burden smaller startups unfairly. A balanced approach often involves strong enforcement against fraud and manipulation while offering predictable pathways for legitimate businesses to comply. This strategy helps reduce the incentive for harmful arbitrage while encouraging responsible growth.

Q: What are the most important research outputs needed to understand global trends in cryptocurrency regulation and policy evolution?

The most important research outputs include a comparative regulatory database that documents how jurisdictions define and regulate crypto assets, a timeline that tracks policy evolution events, and analytical reports that connect regulatory approaches to real-world outcomes. Policymakers need evidence-based insights into which frameworks improve consumer protection and market integrity without driving innovation offshore. Industry participants need practical compliance guidance that reflects cross-border realities. Researchers and the public benefit from clear explanations of regulatory models, key drivers of policy shifts, and emerging global standards. Together, these outputs help stakeholders anticipate future changes and make better decisions in an evolving digital asset economy.