The crypto market moves in powerful cycles, and every cycle crowns its own leaders. As liquidity returns, narratives crystallize and capital concentrates in projects that pair real-world utility with compelling tokenomics, resilient communities, and clear catalysts. In this in-depth guide, we’ll explore three crypto coins that have the ingredients to lead the next bull run: Bitcoin (BTC), Ethereum (ETH), and Chainlink (LINK). These assets represent three pillars of the digital asset landscape—sound digital money, a programmable settlement layer, and mission-critical oracle infrastructure—each with unique drivers that can compound in a rising market.

Before we dive in, remember that cryptocurrencies are speculative and highly volatile. Nothing here is financial advice. Use this analysis as a research foundation, combine it with your own due diligence, and size positions responsibly. With that said, let’s map the terrain, examine the catalysts, and understand the risks that could shape outcomes in the coming cycle.

Why These 3? A Quick Framework for Selection

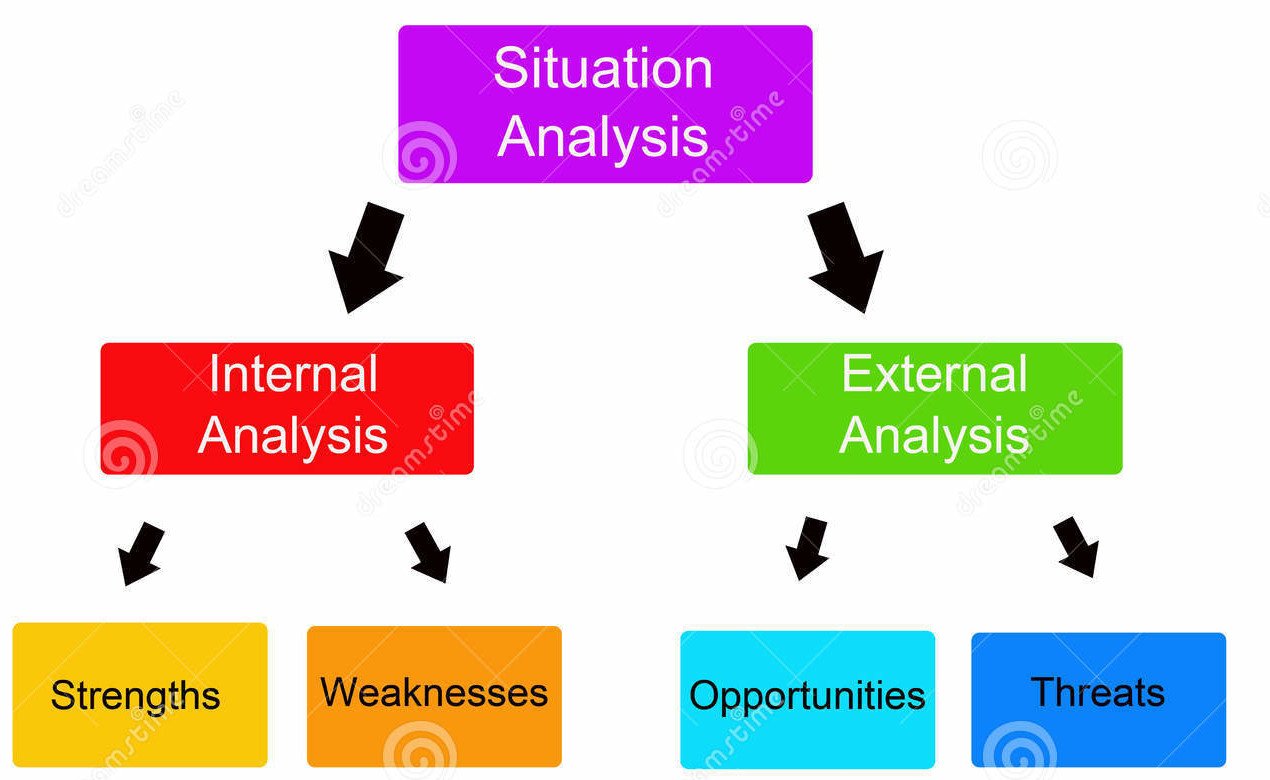

Picking winners for the next bull run isn’t about chasing yesterday’s charts. It’s about triangulating durable fundamentals, network effects, and upcoming milestones. We’ll apply a simple framework across each of our chosen crypto coins:

First, we look for defensible product-market fit. Bitcoin’s role as non-sovereign digital money is distinct. Ethereum’s smart contracts and DeFi rails power thousands of apps. Chainlink’s secure oracles connect blockchains to real-world data and trigger countless transactions. Assets with real utility are more likely to sustain momentum beyond speculative manias.

Second, we evaluate catalytic events and structural demand. For Bitcoin, macro trends and ongoing institutionalization can drive liquidity. Ethereum, layer-2 scaling, and a maturing staking economy can deepen usage. For Chainlink, expanding oracle services, enterprise adoption, and cross-chain connectivity can turn growth into reflexive demand for the native token.

Third, we weigh risks. Protocol upgrades, regulatory landscapes, and competitive pressure matter. We’ll be explicit about the bear cases and how to monitor them through on-chain metrics, adoption signals, and developer traction.

Bitcoin (BTC): Digital Reserve Asset with Reflexive Tailwinds

The Core Thesis

Bitcoin remains the flagship cryptocurrency and the gateway for new capital entering the space. Its scarcity schedule, decentralized proof-of-work security, and longest track record confer a unique status as the market’s base collateral and macro hedge. During expansions, Bitcoin often leads as institutions re-enter, risk budgets widen, and allocation models favor the deepest market capitalization and most battle-tested asset.

Why Bitcoin Can Lead the Next Bull Run

One reason Bitcoin can spearhead the next bull run is its role as a liquidity magnet when risk appetite returns. Portfolio managers seeking crypto exposure typically begin with BTC due to its governance simplicity, transparent tokenomics, and integration across custodians, brokers, and traditional market rails. As flows increase, the resulting bid can compress spreads, tighten basis, and catalyze a broader rotation into altcoins.

Another driver is narrative durability. Themes like digital gold, protection against monetary debasement, and censorship-resistant value transfer transcend crypto-native circles. Each cycle brings new cohorts—high-net-worth individuals, treasuries, and institutions—seeking exposure. This persistent demand, paired with an inflexible supply schedule, creates a structurally supportive backdrop.

The final driver is infrastructure maturity. From professional custody and regulated products to compliant trading venues and analytics, Bitcoin benefits most from ongoing institutionalization. As rails expand, friction drops and participation scales. Meanwhile, the network’s settlement finality, robust decentralization, and brand moat help it maintain leadership as capital rotates across the asset class.

What to Watch: On-Chain and Market Indicators

A healthy prelude to a bull phase in BTC typically includes rising long-term holder accumulation, stable or declining exchange balances, and increasing on-chain settlement throughput. You can also track hash rate trends, miner balance behavior, and derivatives indicators such as futures basis and funding rates. Together, these clues show whether conviction is building or speculation is overheating.

Key Risks and Mitigations

Bitcoin’s main risks are regulatory shocks, macro tightening that throttles risk assets, and narratives that temporarily outshine the “digital gold” story. High rates can dampen speculative flows and compress risk premia. That said, long-duration demand, conservative treasury policies, and incremental regulatory clarity can buffer drawdowns and set up recovery when conditions ease.

Ethereum (ETH): The Settlement Layer of the Decentralized Economy

The Core Thesis

Ethereum is the programmable substrate for decentralized finance (DeFi), NFTs, on-chain identity, and tokenized assets. By combining proof-of-stake security with composable smart contracts, Ethereum anchors the largest developer community in crypto and an expanding universe of layer-2 networks. In bull markets, activity on Ethereum and its L2s tends to surge, generating fee revenue, increasing staking rewards, and reinforcing ETH’s role as the asset that powers blockspace.

Why Ethereum Can Lead the Next Bull Run

The engine behind Ethereum’s upside is the flywheel between developers, users, and capital. When the next bull run begins, new applications launch, existing protocols expand, and liquidity returns to DeFi venues. As transactions climb, L2s absorb demand, fees stabilize, and usability improves. This dynamic unlocks growth across trading, lending, payments, and innovative primitives like restaking, modular data availability, and on-chain identity.

ETH also benefits from structural sinks. Staking removes circulating supply while aligning incentives for network security. Base fees burned during periods of high usage can reduce net issuance, improving ETH’s monetary profile during peak activity. In a reflationary market with rising throughput, this pairing can accentuate upside reflexivity.

From an adoption standpoint, enterprises exploring tokenization and settlement increasingly look to Ethereum’s standards and tooling. Whether it’s institutional DeFi, permissioned deployments that bridge to public liquidity, or regulated stablecoins, Ethereum’s network effects create a default-choice advantage. Each integration strengthens the moat and sets expectations for future growth.

What to Watch: Adoption and L2 Scaling

To gauge Ethereum’s leadership potential, monitor daily active addresses across Ethereum and major L2s, total value locked in DeFi, and developer activity measured by repos, commits, and hackathon traction. Pay attention to improvements in L2 throughput and latency, bridges between L2s, and wallet UX that reduce friction for mainstream users. Better onboarding can expand the top of the funnel and sustain momentum deeper into a cycle.

Key Risks and Mitigations

Ethereum’s biggest risks are competition from high-throughput altcoins, fee spikes that deter retail users, and complexity that can create implementation risk. Robust client diversity, incremental upgrades, and L2 advancements mitigate these risks over time. Meanwhile, app-specific scaling, account abstraction, and improved custody/permissions for institutions can open fresh demand channels.

Chainlink (LINK): The Oracle Network Powering Real-World Connectivity

The Core Thesis

Chainlink is the de facto standard for secure oracle services—bringing off-chain data on-chain, enabling price feeds, settlement conditions, randomness for game mechanics, and cross-chain messaging. Most on-chain economies cannot function without timely, tamper-resistant data, and Chainlink’s decentralized oracle networks fill that critical gap. Because it sits at the nexus of apps and external data, LINK has asymmetric upside in a rising market where both volume and complexity increase.

Why Chainlink Can Lead the Next Bull Run

In the next bull run, as DeFi and on-chain use cases proliferate, demand for reliable oracle services scales with it. Every lending protocol, derivatives venue, prediction market, and tokenized real-world asset platform requires accurate pricing and event triggers. Chainlink’s multi-chain footprint means it captures value wherever activity migrates, whether on Ethereum, layer-2 networks, or other ecosystems.

Chainlink has also expanded beyond price feeds to advanced services like cross-chain interoperability and automation. As projects pursue ecosystem growth across multiple chains, secure messaging and execution become mission-critical. This breadth tightens Chainlink’s integration moat and can buoy sustainable demand for LINK. When rising usage aligns with incentives for node operators and stakers, the network can compound adoption advantages.

Narratively, Chainlink benefits when enterprises experiment with tokenization, real-world assets (RWAs), and data-rich workflows. Financial institutions rolling out on-chain pilots often need a vendor-neutral bridge to external systems. Chainlink’s posture as an infrastructure provider—not a competing chain—helps it partner widely without zero-sum politics.

What to Watch: Integrations and Usage

Keep an eye on the number of live integrations across chains, volume secured by price feeds, and growth in non-price services like automation and cross-chain messaging. Developer documentation updates, hackathon participation, and enterprise case studies can foreshadow demand. On the token side, monitor staking dynamics and node operator incentives; healthy economics support service reliability and long-term adoption.

Key Risks and Mitigations

Risks include competition from alternative oracles, potential centralization criticisms if key operators dominate, and integration friction when protocols build in-house solutions. Mitigations revolve around transparent performance metrics, diversified operator sets, and continual improvements to security guarantees. The project’s longevity and integration breadth are meaningful buffers, but scrutiny will remain high—as it should for critical infrastructure.

How These Narratives Interlock

While each of these crypto coins can shine independently, their narratives reinforce each other in a bull market. Bitcoin’s dominance attracts fresh capital and legitimacy, which then trickles into altcoins as investors seek higher beta. Ethereum’s app layer converts that capital into activity—trades, lending, issuances—deepening the DeFi and NFT economy. Chainlink’s oracles and services keep those systems connected to the real world, enabling more sophisticated products and liquidity to flourish. The interplay can create a reflexive loop: more users, more fees, more integrations, and stronger fundamentals across the stack.

Positioning Strategies and Time Horizons

Different profiles approach these assets differently, but a coherent strategy often blends all three. Risk-aware investors may overweight BTC as core exposure and layer ETH for growth, while allocating a smaller portion to LINK for infrastructure upside. Traders, by contrast, might rotate dynamically based on dominance charts, funding rates, and on-chain metrics like exchange inflows or L2 activity.

Across time horizons, the thesis stays consistent: own the reserve asset that benefits most from institutional adoption, the programmable settlement layer where innovation happens, and the connective tissue that scales ecosystem growth across chains. The mix you choose should reflect your drawdown tolerance, conviction in protocol roadmaps, and need for liquidity during volatile periods.

The Role of Risk Management in a Bull Market

The next bull run will be exciting—and unforgiving. Managing risk matters even when headlines glow. Consider staged entries to reduce timing risk, and define invalidation points where you’ll reassess. Diversify across narratives rather than over-concentrating in a single altcoin with thin liquidity. Keep records of your thesis for each position; when the price moves, revisit the thesis rather than the chart alone. Finally, remember taxes, counterparty risk on exchanges, and security best practices for wallets and staking.

See More: How Altcoins Are Paving the Way for Blockchain’s Mainstream Adoption

Research Checklist You Can Reuse

When evaluating any cryptocurrency, use a disciplined checklist. Confirm real usage, not just testnets or promises. Look for credible teams and public roadmaps. Read audits, but don’t treat them as guarantees. Examine tokenomics: emission schedules, utility, and sinks. Study governance: is it transparent and aligned with users? Evaluate ecosystem growth by developer activity and integrations, not only social metrics. And always triangulate sentiment with data—on-chain metrics, protocol revenue, and user retention tell a clearer story than memes.

Conclusion

The next bull run will reward crypto coins that pair strong fundamentals with clear catalysts and robust ecosystem growth. Bitcoin, Ethereum, and Chainlink each occupy strategic positions in the crypto stack: store of value, programmable settlement, and data connectivity.

Their leadership isn’t preordained, but the ingredients are there—liquidity magnetism, scalable app layers, and indispensable oracle services. As you position for the next phase, focus on verifiable adoption, prudent risk controls, and theses you can articulate in a single sentence. That clarity will serve you better than any hot tip ever could.

FAQs

Q: Are these the only crypto coins likely to lead the next bull run?

No. While BTC, ETH, and LINK are strong candidates, leadership can broaden. High-throughput platforms, innovative layer-2 solutions, or specialized DeFi primitives might outperform at times. Use the same research framework—utility, catalysts, and tokenomics—to vet others.

Q: How should a beginner allocate among Bitcoin, Ethereum, and Chainlink?

There’s no universal split, but many beginners start with a larger BTC allocation for stability, add ETH for growth via smart contracts and DeFi, and use a smaller position in LINK for infrastructure exposure. Your risk tolerance, time horizon, and need for liquidity should guide the final mix.

Q: What signals suggest the next bull run is starting?

Look for improving macro conditions, rising on-chain metrics like active addresses and fees, narrowing spot/derivatives spreads, and consistent inflows into regulated products. Also monitor layer-2 scaling usage, developer activity, and declining exchange balances for major assets.

Q: Is staking ETH or LINK necessary to benefit?

Staking can enhance yield and network security, but it introduces operational and smart contract risks. You can benefit from ecosystem growth without staking; however, if you do stake, use reputable providers or learn self-custody best practices and understand lockup/liquidity terms.

Q: What’s the biggest mistake to avoid in a bull market?

Over-concentration and over-leverage. Chasing late-stage narratives with excessive size or borrowing can erase gains during inevitable pullbacks. Keep position sizing disciplined, plan exits, and revisit your thesis regularly rather than reacting to short-term volatility

By covering these aspects comprehensively, this article meets diverse needs. It provides conceptual clarity for students and researchers, practical insights for professionals, and contextual background for enthusiasts. Such an approach increases engagement and ensures the content ranks well across a broad range of relevant search queries.

By covering these aspects comprehensively, this article meets diverse needs. It provides conceptual clarity for students and researchers, practical insights for professionals, and contextual background for enthusiasts. Such an approach increases engagement and ensures the content ranks well across a broad range of relevant search queries.