The phrase “blockchain stocks” has evolved from a buzzword into a durable investment theme that sits at the intersection of cryptocurrency, distributed ledger innovation, and traditional capital markets. On October 13, 2025, the landscape looks deeper and more institutional than ever. Spot Bitcoin ETFs have reshaped flows, regulated futures have matured, and blue-chip payment networks keep piloting stablecoin rails. Blockchain Stocks Top Picks.

At the same time, miners are adapting to the latest Bitcoin halving economics, while banks experiment with tokenization and real-time settlement. This guide explores the top blockchain stocks worth watching right now, why they matter, and the key catalysts that could drive them next.

Before we dive in, a quick map of the terrain. Investors can group blockchain stocks into five buckets: crypto-native platforms, payment and fintech enablers, enterprise/tokenization leaders, miners/infrastructure providers, and market-structure beneficiaries like exchanges and clearing venues. Each bucket captures a different slice of Web3 adoption—ranging from Bitcoin mining to stablecoin settlement, from smart contracts to tokenization of traditional assets. By understanding these roles, you’ll see why some names can offer leverage to digital assets cycles while others ride secular rails regardless of short-term price swings.

What Counts as a Blockchain Stock in 2025?

“Blockchain stock” doesn’t just mean a company that holds Bitcoin on its balance sheet. It can be a payments network testing stablecoin settlement, a bank scaling tokenized deposits, a custody platform safeguarding institutional assets, a derivatives venue with deep liquidity in crypto futures, or a miner deploying the newest, most power-efficient rigs. The common thread is a meaningful, monetizable link to distributed ledger technology—infrastructure, services, or exposure that rises as digital assets adoption grows.

In practice, that means considering leaders in the following arenas: crypto exchanges/custody, payment rails and DeFi-adjacent UX, enterprise blockchain and tokenization, miners and data centers, and regulated market plumbing. Let’s break those down.

Crypto-Native Platforms: Liquidity, Custody, and Institutional Pipes

Coinbase Global (NASDAQ: COIN)

As institutions have moved from curiosity to allocation, custody, and execution quality matters as much as retail app design. Coinbase’s institutional arm has positioned itself as a critical service provider to asset managers behind spot crypto ETFs, stating that it serves as custodian for a majority of U.S. spot Bitcoin and Ether ETFs launched since 2024. The company highlighted that it custodies 9 of 11 spot Bitcoin ETFs and 8 of 9 spot Ether ETFs, underscoring the depth of its institutional footprint.

Why it’s a “watch” name: As the ETF ecosystem expands and on-exchange liquidity deepens, the platforms that provide compliant custody, prime services, and surveillance share in the economics—often with lower volatility than purely trading-based revenues. For investors seeking blockchain stocks with infrastructure-like qualities, that matters.

BlackRock (NYSE: BLK)

BlackRock isn’t a “crypto company,” yet its iShares Bitcoin Trust (IBIT) has become one of the defining products of this cycle. Recent reporting indicates IBIT has approached the $100 billion AUM mark, cementing it among the largest ETFs in history and signaling enduring mainstream demand for digital assets exposure via traditional wrappers. The trust’s official materials and filings offer additional color on liquidity and operational partners.

Why it’s a “watch” name: Product leadership compounds. If spot crypto ETFs continue drawing flows, issuers that execute at scale—and link back to blockchain market infrastructure—can benefit from fee annuities and brand reinforcement.

Payments and Fintech: Stablecoins, Merchant Acceptance, and Web2→Web3

Visa (NYSE: V)

Visa has run pilots to settle with USDC on public chains, including Ethereum and Solana, expanding beyond earlier issuer experiments to work with merchant acquirers. The company’s September 2023 update described pilots with Worldpay and Nuvei and the use of the Solana blockchain to enhance settlement speed.

Why it’s a “watch” name: Card networks thrive on volume and reliability. If stablecoin rails become a mainstream back-end option, payments players that master digital asset settlement could see incremental efficiency gains and new cross-border corridors.

PayPal (NASDAQ: PYPL)

PayPal launched its U.S. dollar stablecoin (PYUSD) in 2023 and has continued pushing adoption. While third-party industry reports emphasize rising market cap and broader integration, investors should monitor official updates, regulatory developments, and real-world merchant uptake as catalysts.

Why it’s a “watch” name: A fintech with global reach that can embed tokenized dollars into consumer and merchant flows sits at the forefront of Web3 UX—bridging digital assets and everyday payments.

Block, Inc. (NYSE: SQ)

Block’s Cash App has long supported Bitcoin buying, and the company continues to experiment across developer tooling and hardware. While headlines ebb and flow, the broader thesis is clear: making crypto simple at the point of use is a durable edge. Investors watching blockchain stocks often view consumer fintech as the adoption interface.

Enterprise & Tokenization: Banks and the New Back Office

JPMorgan Chase (NYSE: JPM)

JPMorgan’s blockchain unit—originally Onyx—has been reintroduced as Kinexys by J.P. Morgan, signaling a scaled push across next-gen financial infrastructure and tokenized payments. The bank’s materials describe the rebrand and its focus on payment settlement and broader tokenization initiatives—building on years of production pilots like JPM Coin.

Why it’s a “watch” name: If tokenization of deposits, collateral, and funds accelerates, the global banks that ship production-grade platforms could capture a share of high-margin, real-time financial plumbing.

CME Group (NASDAQ: CME)

Though not an “enterprise blockchain” vendor, CME is a market-structure infrastructure for digital assets. Its regulated Bitcoin and Ether futures complexes are deep and widely referenced. CME’s own crypto insights highlight record levels of open interest and the introduction of new products such as Ether/Bitcoin ratio futures and spot-quoted contracts in 2025. The exchange also offers “micro” futures contracts sized at a fraction of a coin, allowing more precise risk management.

Why it’s a “watch” name: If institutional traders prefer regulated venues for price discovery and hedging, blockchain market participation can translate into stable, fee-based revenues for the exchange that dominates liquidity.

Miners and Infrastructure: Hashrate, Energy, and Post-Halving Economics

Marathon Digital (NASDAQ: MARA)

Marathon has emphasized large-scale expansion and operational efficiency through market cycles. Company updates in 2025 referenced surging hashrate versus the prior year, illustrating how scale players attempted to offset the halving’s revenue impact with capacity growth and cost optimization.

Why it’s a “watch” name: For miners, the story is a spread—Bitcoin price minus all-in cost. The leaders that control power costs, improve fleet efficiency, and diversify into high-performance computing (HPC) or AI hosting can build downside buffers while maintaining upside torque to digital assets cycles.

Riot Platforms (NASDAQ: RIOT)

Riot’s acquisition of Block Mining expanded its potential power capacity toward two gigawatts, with a roadmap to add exahashes of hashrate by the end of 2025. Company press releases detail how the deal added immediate operational capacity, a pipeline for expansion, and a broader geographic footprint.

Why it’s a “watch” name: In a post-halving world, scale and energy strategy determine survival. Operators that secure low-cost power and can flex into AI/HPC hosting are positioned to ride multiple secular waves tied to blockchain and compute.

Strategy (formerly MicroStrategy) (NASDAQ: MSTR)

Strategy remains the largest public-company proxy for Bitcoin on corporate balance sheets. Recent reporting places holdings above 640,000 BTC, with valuations swinging alongside spot prices. For investors who want a leveraged way to express a digital assets view without directly owning coins, corporate treasuries like Strategy’s are an explicit bet.

Why it’s a “watch” name: While not “infrastructure,” Strategy’s stock often reflects BTC beta plus an operational premium/discount—useful for portfolio construction when you’re mapping blockchain stocks across risk levels.

Market-Structure Winners: Liquidity, Data, and Derivatives

Beyond ETFs and miners, attention is shifting to the less glamorous but essential components of adoption—futures, options, and clearing. CME’s crypto complex has introduced new contract types and reported record open interest in late 2024, with ongoing product innovation through 2025. As liquidity professionalizes, these venues create standardized risk-transfer tools that allow a broader cohort—hedge funds, corporates, market makers—to participate safely. In plain English: better market plumbing can extend the cycle.

The Macro Backdrop: Why October 2025 Feels Different

The last 18 months reshaped the investing on-ramp. Spot ETFs turned Bitcoin exposure into a brokerage-account click, with IBIT’s rapid ascent demonstrating demand at an institutional scale. Regulated futures at CME continue to deepen, including ratio products and micro contracts that help desks fine-tune exposure. Payment giants test stablecoin rails in production pilots. Major banks reframe tokenization as a multi-year infrastructure upgrade, not a lab experiment. Put together, the ecosystem now offers multiple, overlapping channels for capital to meet code—exactly the kind of redundancy that supports long cycles.

For blockchain stocks, that redundancy matters. ETF flows or derivatives volumes can keep the flywheel turning. When miners face margin compression, diversified compute or energy strategies can buffer outcomes. Regulators sharpen rules, the winners are often those already operating inside compliance perimeters—custodians, exchanges, and banks with prudential oversight.

Key Themes to Watch Through Year-End

The Tokenization Flywheel

As banks and asset managers digitize money and collateral, “settlement finality” windows shrink and capital efficiency rises. Kinexys (JPMorgan’s rebranded blockchain unit) frames this as a next-gen infrastructure buildout—think programmable payments and tokenized deposits. The spillover for blockchain stocks is subtle: incumbents that monetize network effects (transaction volumes, custody balances, fund flows) gain durable, fee-like revenue streams.

Stablecoins as a Back-End, Not a Buzzword

Visa’s pilots signal a thesis: stablecoins can reduce frictions in cross-border and merchant settlement, even if the cardholder never sees “crypto.” PayPal’s PYUSD keeps pushing consumer-facing rails toward digital dollar UX, a potential bridge between Web2 and Web3 commerce. If policy clarity improves, the addressable market expands from crypto-native users to everyday merchants and platforms.

Market Structure Matures

CME’s ongoing product innovation—from micro contracts to ratio and longer-dated spot-quoted futures—supports institutional participation by making risk management more granular. That’s a secular tailwind for blockchain stocks tied to venues, clearing, and data.

The Miner Pivot

Post-halving, electricity and efficiency dominate. Leaders like Riot and Marathon are scaling power footprints and fleets, with some exploring AI/HPC hosting to diversify revenue. Company disclosures through 2024–2025 illustrate how capacity expansion and acquisitions aim to preserve margins amid changing issuance rewards.

Stock-Picking Framework for Blockchain Exposure

1) Decide Your Beta

If you want high correlation to Bitcoin, miners, and corporate-treasury plays like Strategy offer torque. If you prefer market-structure resilience, consider venues (CME) and custodians (Coinbase), which can earn through cycles as long as volumes and assets remain healthy. Blockchain Stocks Top Picks.

2) Prioritize Moats

In a competitive field, look for regulators’ blessing, balance-sheet strength, network effects, and brand credibility. Visa’s and JPMorgan’s enterprise blockchain initiatives reflect exactly that: distribution and compliance first, experimentation second.

3) Watch the Plumbing

ETF flows and futures open interest often precede earnings inflections for the vendors behind them. IBIT’s AUM trajectory showcases how fee economics can compound. CME’s liquidity metrics and product cadence hint at durable demand for hedging and basis trades.

4) Mind the Unit Economics

For miners, watch all-in cost per BTC, power contracts, and fleet efficiencyExchangeses/custody, track take-rates, safekept AUC, and institutional mix. For payments, look at settlement pilots graduating into production volume, not just press releases. Blockchain Stocks Top Picks.

Company Snapshots: Catalysts and Considerations

Coinbase: Institutional Custody as a Competitive Edge

Coinbase’s role across U.S. spot ETF ecosystems reinforces its reputation among asset managers. As staking policies, new tokens, and cross-margin features evolve, watch for updates that broaden wallet share among funds and corporates. If Ethereum staking or tokenized Treasurys become more mainstream, the custody moat deepens.

BlackRock: ETF Scale and the Network Effect

A near-$100B spot Bitcoin ETF would have sounded fanciful a few years ago; today it’s a case study in distribution and trust. For equity investors, the takeaway isn’t “crypto hype”—it’s that digital assets can produce serious fee pools when embedded in familiar wrappers. Blockchain Stocks Top Picks.

Visa and PayPal: Bringing Web3 to Web2 Rails

Visa’s USDC pilots and PayPal’s PYUSD initiative demonstrate a pragmatic approach: start small, measure, and scale. If regulators codify stablecoin frameworks, expect more acquirers and wallets to join, turning pilots into production.

JPMorgan: From Pilots to Platforms

With Kinexys, JPMorgan is treating tokenization as core infrastructure, not an R&D side project. For investors, the signal is about operating leverage: once the pipes are live and compliant, volumes can travel them for years . Blockchain Stocks Top Picks.

CME Group: Regulated Liquidity as the Moat

New contracts, such as Ether/Bitcoin ratio futures and spot-quoted listings, extend CME’s toolkit for institutional hedgers. If regulated venues continue to out-compete offshore alternatives for large flow, venues like CME capture that migration. Blockchain Stocks Top Picks.

Marathon & Riot: Scale, Power, Diversification

Marathon’s hashrate growth through 2025 and Riot’s capacity-expanding acquisition illustrate how leaders are fighting post-halving compression. The next catalysts: energy deals, fleet refresh cycles, and any credible revenue from AI/HPC hosting.

Strategy (MicroStrategy): The Proxy Trade

Strategy’s BTC stack has grown into a market-moving treasury position, with holdings tracked closely by markets and media. The equity remains a high-beta Bitcoin expression—useful but volatile.

Risks That Matter

Regulatory shifts can alter the economics of stablecoins, staking, or custody overnight. Liquidity crunches can compress take-rates or widen spreads. For miners, power-price spikes and difficulty adjustments can swing margins. ETF demand can ebb if macro tightens. As always, this overview is educational, not investment advice; do your own ddiligenceBlockchain Stocks Top Picks

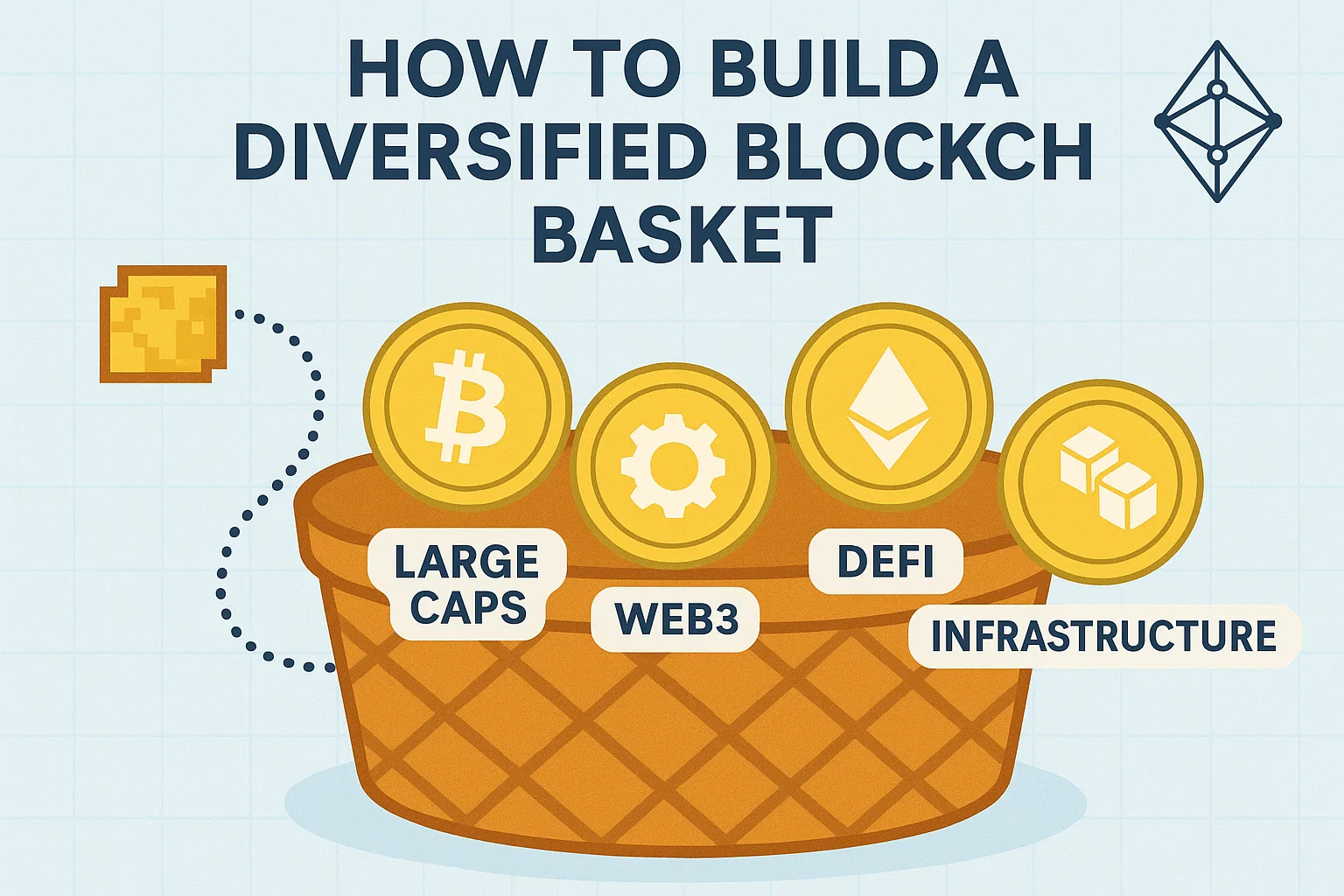

How to Build a Diversified Blockchain Basket

A -pragmatic approach spreads exposure across infrastructure (CME, Coinbase), payments (Visa, PayPal), enterprise/tokenization (JPMorgan), and torque (Marathon, Riot, Strategy). That mix balances secular rails with cyclical upside. Layer in position sizing and risk controls, and you’ve constructed a portfolio that can participate if Web3 adoption keeps compounding, without being a single-factor bet. Blockchain Stocks Top Picks.

The Bottom Line

On October 13, 2025, blockchain stocks look less like a speculative corner and more like an ecosystem with redundant on-ramps: ETFs for mass investors, regulated futures for pros, stablecoins for payments, tokenization for banks, and scaled miners powering the network. The winners are building moats around Liquidity, Trust, and Distribution—the same pillars that drove earlier fintech waves. If that continues, the next leg of value accrual may come from the rails, not just the coins. Blockchain Stocks Top Picks.

Final Word on Keywords and Readability

You’ll notice we’ve used blockchain stocks naturally throughout, along with related phrases like cryptocurrency, digital assets, distributed ledger, Web3, DeFi, tokenization, enterprise blockchain, smart contracts, and Bitcoin mining. These LSI keywords keep the article relevant without sacrificing clarity, helping search engines understand context while staying useful for humans.

See More: Best Cryptocurrency Trading Platform for Beginners Top 7 Picks 2025

Conclusion

The era of pilots is giving way to production. Spot ETFs have mainstreamed access; regulated derivatives provide professional risk tools; payment networks are testing stablecoin rails; banks are tokenizing the back office; and miners are professionalizing power and fleet strategy. As you evaluate blockchain stocks, focus on moats, unit economics, and where each name sits in the value chain. The most resilient plays earn across cycles because they sell the picks and shovels of digital assets—not just the gold. Blockchain Stocks Top Picks.

FAQs

Q: Are blockchain stocks the same as crypto coins?

No. Blockchain stocks are shares of companies building or profiting from distributed ledger technology—exchanges, payment networks, banks, miners, and market venues. They can benefit from digital assets adoption, but aren’t coins themselves.

Q: Why do ETFs matter for blockchain stocks?

Spot ETFs funnel traditional capital into Bitcoin and other digital assets, which can lift volumes for custodians, exchanges, and derivatives venues. IBIT’s rapid ascent toward $100B AUM is a prime example of mainstream adoption through familiar wrappers.

Q: What role do stablecoins play for payment companies?

Stablecoins can streamline settlement and cross-border flows. Visa has piloted a USDC settlement with major acquirers and used the Solana blockchain to improve speed, while PayPal launched PYUSD to explore consumer and merchant use cases.

Q: How do miners create shareholder value after halvings?

Scale, power costs, and efficiency. Leaders like Marathon and Riot are expanding capacity and optimizing fleets; some are exploring AI/HPC hosting to diversify revenue beyond Bitcoin mining.

Q: What’s a good way to start researching blockchain stocks?

Map the value chain—custody/exchanges (Coinbase), payments (Visa, PayPal), enterprise/tokenization (JPMorgan), market structure (CME), miners (Marathon, Riot), and corporate BTC proxies (Strategy). Then read official filings, product pages, and press releases for each, such as CME’s crypto product overviews and quarterly insights.