The latest UK inflation data analysis has sparked renewed debate among economists, policymakers, and investors. While headline figures suggest progress in bringing price pressures under control, several mixed signals remain beneath the surface. These conflicting indicators raise a crucial question: Is the United Kingdom truly on a sustainable path toward interest rate cuts, or is inflation proving more persistent than anticipated?

Over the past few years, the UK economy has navigated extraordinary turbulence. From pandemic disruptions and supply chain shocks to energy price surges and geopolitical uncertainty, inflation accelerated at a pace not seen in decades. The response from the Bank of England involved aggressive monetary tightening, pushing interest rates higher to curb demand and stabilize price growth.

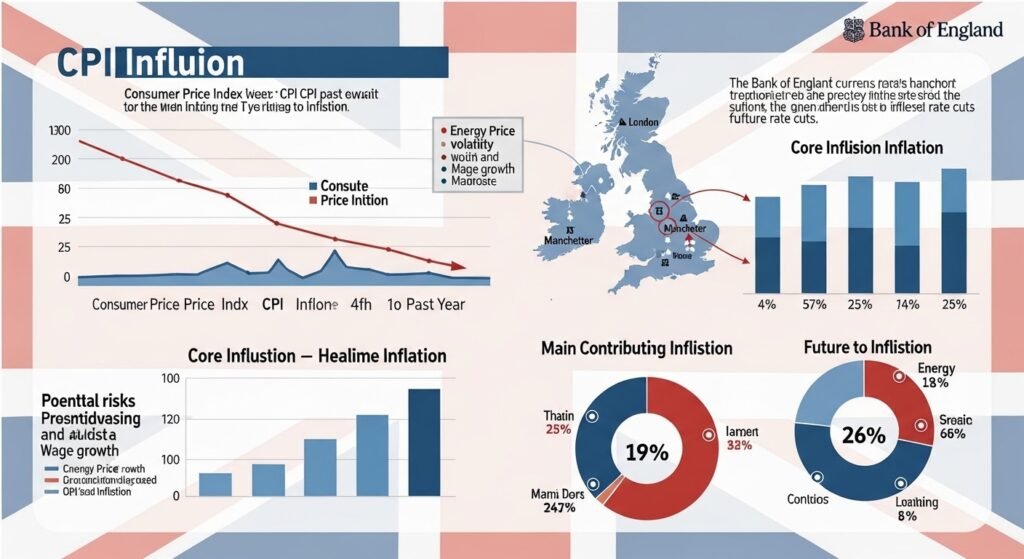

Now, as fresh data emerges, analysts are examining whether conditions are aligning for policy easing. A detailed UK inflation data analysis reveals nuanced trends in consumer price index movements, core inflation dynamics, wage growth, and broader economic activity. Although inflation has moderated from peak levels, the underlying picture is complex.

Understanding the implications of this data is critical for households, businesses, mortgage holders, and financial markets. Rate cuts could stimulate economic activity and ease borrowing costs, but premature action risks reigniting inflationary pressures. This article explores the key components of the latest UK inflation data analysis and examines whether the evidence supports a credible path toward rate reductions despite lingering uncertainty.

The Current State of UK Inflation

A comprehensive UK inflation data analysis begins with examining headline figures. The Consumer Price Index, commonly referred to as CPI, has declined significantly from its multi-decade highs. This moderation reflects easing energy prices, improved supply chains, and slowing goods inflation.

However, while headline inflation has cooled, the decline has not been entirely smooth. Month-to-month fluctuations continue to produce mixed readings. In some periods, energy and food prices have stabilized, but services inflation has remained stubbornly elevated.

Core inflation, which excludes volatile components such as food and energy, provides a clearer picture of underlying price pressures. Recent data shows that core inflation has eased but remains above the Bank of England’s target. This mixed performance complicates policymaking, as the central bank must assess whether the downward trajectory is sustainable.

Despite these complexities, the overall UK inflation data analysis suggests that the peak inflationary phase has likely passed. The crucial question is whether this downward momentum will continue long enough to justify rate cuts.

The Role of the Bank of England

The Bank of England plays a pivotal role in interpreting UK inflation data analysis. Its mandate focuses on maintaining price stability while supporting economic growth. Over the tightening cycle, policymakers implemented multiple interest rate increases to combat runaway inflation.

Higher rates cooled demand, slowed housing activity, and reduced credit expansion. These measures gradually dampened inflationary momentum. As price pressures moderate, the central bank now faces the delicate task of balancing caution with economic support.

Monetary policy decisions depend not only on current inflation readings but also on forward-looking expectations. If UK inflation data analysis indicates that inflation expectations remain anchored, policymakers may gain confidence to consider gradual rate cuts.

However, officials remain wary of declaring victory prematurely. Past episodes of inflation have demonstrated that price pressures can resurface if policy easing occurs too quickly.

Mixed Signals Beneath the Surface

While headline inflation trends downward, a deeper UK inflation data analysis uncovers mixed signals across different sectors of the economy. Services inflation, driven largely by domestic demand and wage growth, remains relatively sticky.

Wage growth has shown resilience, reflecting tight labor market conditions. Although job vacancies have declined from peak levels, employment remains relatively robust. Strong wage gains support household incomes but can also sustain inflationary pressures if businesses pass higher labor costs onto consumers.

Another area of concern involves housing-related costs. Rental inflation and mortgage rates continue to impact household budgets. Even as energy prices decline, housing and service expenses contribute to persistent price pressures.

These mixed signals suggest that while inflation is cooling overall, underlying dynamics may slow the pace of disinflation. Policymakers must carefully weigh these factors in their rate decisions.

Economic Growth and Consumer Spending Trends

An essential component of UK inflation data analysis is the broader economic environment. Gross Domestic Product growth has shown periods of stagnation, with occasional quarters of weak expansion. Slower economic activity reduces demand-driven inflation, strengthening the case for rate cuts.

Consumer spending patterns reveal a cautious but stable outlook. Households have adjusted to higher borrowing costs by moderating discretionary purchases. Retail sales data reflects subdued demand in certain sectors, while essential goods consumption remains steady.

Business investment has also experienced uneven performance. Elevated borrowing costs and global uncertainty have dampened expansion plans in some industries. A path toward rate cuts could potentially revive investment activity and improve economic confidence.

The interplay between slowing growth and moderating inflation strengthens arguments that the tightening cycle may be nearing its end.

Global Influences on UK Inflation

UK inflation data analysis cannot ignore global factors. International energy prices, commodity markets, and exchange rate fluctuations all influence domestic price levels.

The stabilization of global energy markets has contributed significantly to declining inflation in the UK. Supply chain normalization has further eased goods price pressures. However, geopolitical tensions and global trade disruptions remain potential risks.

Currency movements also affect imported inflation. A stable or stronger pound reduces the cost of imported goods, supporting disinflation. Conversely, currency volatility could complicate the outlook.

These global influences create a dynamic environment in which domestic policy decisions interact with international developments.

Financial Markets and Rate Cut Expectations

Financial markets closely monitor UK inflation data analysis to anticipate monetary policy shifts. Bond yields, currency markets, and equity indices respond rapidly to inflation releases.

Market participants have begun pricing in potential rate cuts, reflecting optimism that inflation will continue to decline. Lower bond yields indicate expectations of easing monetary policy in the coming quarters.

However, volatility persists. Unexpected inflation upticks or stronger wage data can quickly alter rate cut projections. Investors must remain attentive to new data releases and central bank communication.

The alignment between inflation trends and market expectations will shape the timing and magnitude of any rate reductions.

Risks That Could Delay Rate Cuts

Despite encouraging signals, risks remain. Persistent services inflation could delay policy easing. If wage growth remains elevated, the Bank of England may hesitate to reduce rates.

External shocks, such as renewed energy price spikes or supply disruptions, could reverse disinflation progress. Additionally, inflation expectations among consumers and businesses must remain anchored to prevent price-setting behaviors from accelerating.

UK inflation data analysis must therefore consider downside and upside risks simultaneously. Policymakers are likely to adopt a data-dependent approach, adjusting their stance as new information emerges.

The Potential Impact of Rate Cuts

If UK inflation data analysis ultimately supports rate reductions, the impact would extend across multiple sectors. Lower borrowing costs could stimulate housing activity, ease mortgage pressures, and encourage business investment.

Consumer confidence may improve as households experience relief from high interest expenses. Financial markets could respond positively, boosting equity valuations and supporting capital flows.

However, gradualism is likely. The Bank of England would probably implement cautious and incremental cuts to avoid reigniting inflation. Sustainable disinflation remains the primary objective.

Long-Term Outlook for the UK Economy

The broader economic outlook depends on maintaining stability while fostering growth. UK inflation data analysis indicates that progress has been made, but structural challenges remain.

Productivity growth, labor market flexibility, and fiscal policy decisions will influence long-term economic performance. Coordinated strategies between monetary and fiscal authorities can enhance resilience.

If inflation continues trending downward and economic activity stabilizes, the path to rate cuts may become clearer. Achieving this balance would represent a significant milestone in the post-inflation recovery phase.

Conclusion

The latest UK inflation data analysis reveals a cautiously optimistic picture. Headline inflation has moderated significantly, and broader economic conditions suggest that restrictive monetary policy has achieved its intended effect. Yet mixed signals remain, particularly in services inflation and wage growth.

The path to rate cuts appears increasingly plausible, but policymakers must remain vigilant. Sustainable disinflation requires careful monitoring of underlying trends and external risks. A measured approach to easing could support growth without compromising price stability.

For households and businesses alike, the prospect of lower rates offers hope for relief after a prolonged tightening cycle. Whether the Bank of England moves swiftly or gradually, UK inflation data analysis will continue to shape expectations and guide decision-making in the months ahead.

FAQs

Q: What does UK inflation data analysis indicate about future interest rates?

UK inflation data analysis suggests that inflation has moderated from peak levels, increasing the likelihood of future rate cuts. However, policymakers remain cautious due to persistent services inflation and wage growth. The trajectory indicates progress, but confirmation of sustained disinflation is necessary before significant rate reductions occur.

Q: Why are mixed signals important in evaluating rate cut decisions?

Mixed signals highlight that not all components of inflation are declining uniformly. While headline CPI may fall due to lower energy prices, underlying price pressures such as services inflation or strong wage growth can persist. Central banks consider these details carefully to avoid premature easing that could trigger renewed inflation.

Q: How does wage growth affect the UK inflation outlook?

Wage growth plays a critical role because rising labor costs can fuel services inflation. If businesses pass higher wages onto consumers through price increases, inflation may remain elevated. Sustained moderation in wage growth would strengthen the case for rate cuts.

Q: What impact could rate cuts have on households and businesses?

Rate cuts could reduce borrowing costs, lower mortgage payments, and stimulate consumer spending. Businesses may benefit from cheaper financing, encouraging investment and expansion. However, gradual implementation is likely to ensure inflation remains under control.

Q: Are there risks that could prevent the Bank of England from cutting rates soon?

Yes, several risks could delay rate cuts, including persistent core inflation, external economic shocks, and rising inflation expectations. Policymakers will closely monitor incoming data before making decisions, ensuring that any easing aligns with long-term price stability goals.